Drake Tax Software: What it is and how it works

Drake Tax Software is a comprehensive tax preparation tool designed to streamline the filing process, reduce errors, and keep users compliant with both state and federal tax laws.

Read MoreWhat is Comprehensive Financial Planning: What are its benefits?

Explore the benefits of comprehensive financial planning. comprehensive financial planning is to set goals, evaluate your financial situation, and prepare for the future

Read MoreTop Online Accounting and Bookkeeping Firms for Startups

Top best online CPA, accounting and bookkeeping firms for startups, offering expert financial services to help you manage your finances and grow your business efficiently.

Read MoreBest Accounting Firms for Small Businesses

Best accounting firms for small businesses, offering expert bookkeeping, tax planning, and financial services to help you grow, stay compliant, and maximize profits.

Read MoreTop 10 Accounting Firms in the United States: Tampa, Florida

Top 10 accounting firms in united states: Tampa, Florida, offering expert financial services. Explore the best firms to meet your business and personal accounting needs

Read MoreCalifornia state income tax brackets and rates 2024

California state income tax range from 1% to 12.3%, and the sales tax rate is 7.25% to 10.75%. Your tax rate and bracket are based on your income and filing status

Read MoreEarned Income Tax Credit 2025-2026: Who qualifies for EITC?

The Earned Income Tax Credit (EITC) is a refundable benefit for low- to middle-income workers. For 2025-2026, credit amounts vary by income, filing status, and dependents.

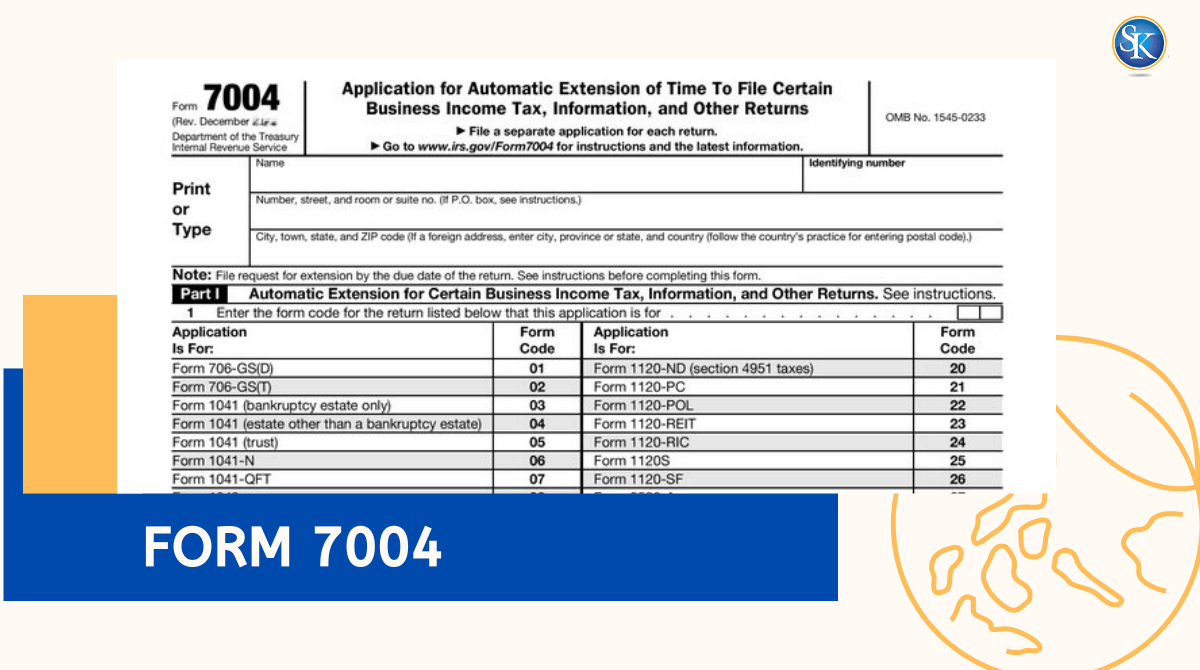

Read MoreHow to File IRS Form 7004 for Business Tax Extensions

Form 7004, “Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and allows businesses to extend the deadline for filing their tax returns.

Read MoreWhy do I owe taxes this year 2026?

Why do I owe taxes this year? Learn about changes in income, withholding, tax credits, and more that could be behind your 2025 tax bill and how to avoid it

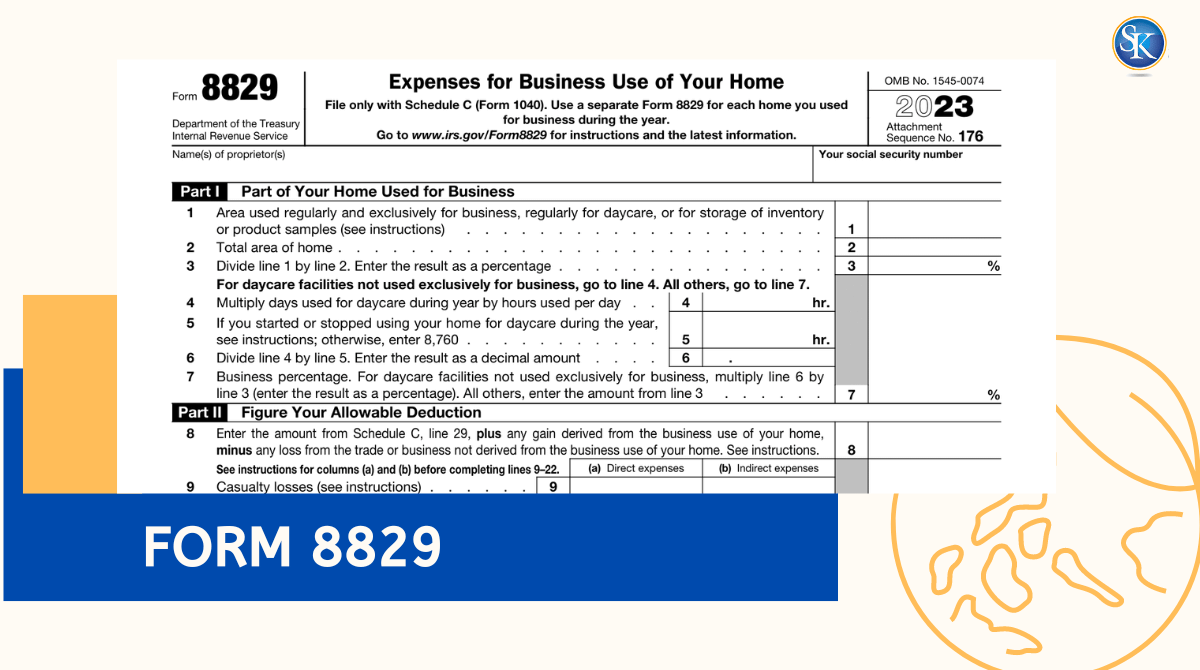

Read MoreIRS Form 8829 : A Complete Guide to Expensing Your Home Office

Form 8829 is the official IRS document that helps you calculate how much of your home expenses can be deducted for business. When you fill it out, the total deduction moves to Schedule C

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us