What Is the IRS Form 8880? How to Fill Out Form 8880

IRS Form 8880 is the form taxpayers use to claim the Saver’s Credit a tax credit available to people who contribute to a retirement plan and meet income requirements. The credit can reduce your tax bill by up to $1,000 if you file single or $2,000 if you’re married filing jointly.

What Is Form 8880?

Form 8880 allows you to claim the Retirement Savings Contributions Credit (Saver’s Credit).

This credit applies when you contribute to:

-

Traditional or Roth IRA

-

401(k), 403(b), 457(b)

-

SIMPLE IRA or SEP IRA

-

Solo 401(k) (self-employed)

It is a non-refundable credit, meaning it can reduce your tax owed but cannot generate a refund.

Ask questions here about CPA and CFP

Who Is Eligible for Form 8880?

You can claim the credit if ALL are true:

-

You are 18 or older

-

You are not a full-time student

-

You are not claimed as a dependent

-

You made a qualified retirement contribution

- Your AGI falls within IRS limits

Saver’s Credit Income Limits for 2025 (Filed in 2026)

|

Credit Rate |

Married Filing Jointly |

Head of Household |

Single / MFS |

|

50% |

Up to $47,500 |

Up to $35,625 |

Up to $23,750 |

|

20% |

$47,501–$51,000 |

$35,626–$38,250 |

$23,751–$25,500 |

|

10% |

$51,001–$79,000 |

$38,251–$59,250 |

$25,501–$39,500 |

|

0% / Not Eligible |

Above $79,000 |

Above $59,250 |

Above $39,500 |

What Contributions Count Toward Form 8880?

Eligible contributions include:

-

Your own IRA/401(k) contributions

-

Voluntary salary deferrals

-

After-tax contributions (Roth IRA)

Not eligible:

-

Employer match

-

Rollovers

-

Excess contributions above IRS limits

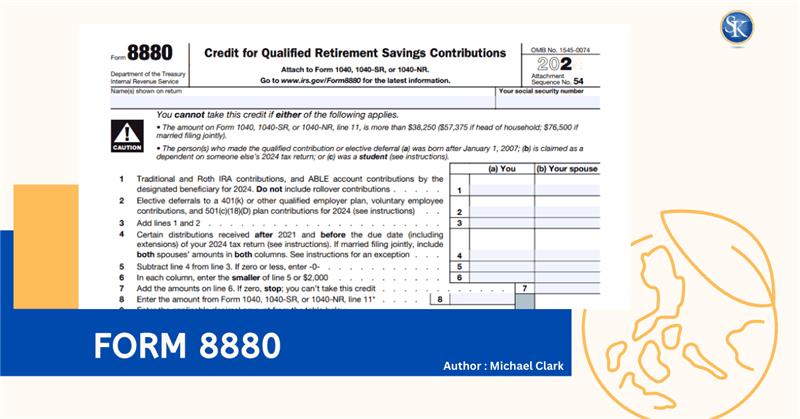

How to Fill Out Form 8880

-

Download Form 8880 from the IRS website.

-

Fill in your personal information (name, SSN, filing status).

-

Enter your total retirement contributions on Line 1.

-

Enter retirement distributions from the prior two years on Lines 2–3.

-

Subtract withdrawals from contributions and enter on Line 4.

-

Use the table on Form 8880 to find your credit rate based on your AGI.

-

Multiply Line 4 by the credit percentage → enter the result on Line 10.

-

Attach Form 8880 to Form 1040 when filing.

Most tax software completes this automatically.

Common Mistakes to Avoid When Filing Form 8880

-

Forgetting to subtract recent retirement withdrawals

-

Assuming employer contributions count toward the credit

-

Missing the April 15, 2026 filing deadline

-

Exceeding retirement contribution limits

-

Filing the form even when income is above eligible limits

These small errors can reduce or eliminate your credit.

Why Should You File Form 8880?

Form 8880 helps you:

-

Reduce your federal tax bill

-

Get rewarded for saving for retirement

-

Build long-term retirement security

-

Take advantage of a credit many taxpayers accidentally miss

Since the Saver’s Credit directly lowers your tax liability, it’s one of the simplest and most beneficial credits for retirement savers.

Who Benefits Most From Filing Form 8880?

People who fall into the lower or moderate income brackets receive the highest credit percentage. New savers, part-time workers, single parents, and early-career employees often benefit the most. Even small contributions can qualify for the 50% credit rate.

Conclusion

Form 8880 is a straightforward way to save money while investing in your future. If you contribute to a qualifying retirement account and meet the income limits, claiming the Saver’s Credit can put real money back in your pocket.

FAQs

1. Can I claim Form 8880 if I contributed to a Roth IRA?

Yes, Roth IRA contributions qualify.

2. Does employer matching count toward the Saver’s Credit?

No. Only your own contributions count.

3. Can I claim the Saver’s Credit if I use tax software?

Yes. Software automatically completes Form 8880 if you qualify.

4. What’s the maximum Saver’s Credit for 2025?

$1,000 for single filers, $2,000 for married couples.

5. Is Form 8880 refundable?

No. It reduces taxes owed but does not create a refund.

6. What income counts for eligibility?

Your Adjusted Gross Income (AGI) determines your credit rate.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.