Incorporation vs. Corporation: What's the Difference?

Creating a corporation is called incorporation, and the legal business entity you get after that is called a corporation. If you're starting a business, you'll see these two words a lot in forms, legal advice, and talks with accountants or investors. They sound very similar, but mixing them up can be confusing or even cost you money.

We'll explain the difference in this blog. By the end, you'll not only know what Incorporation vs. Corporation means, but you'll also know how to use that knowledge to make better decisions for your business.

Learn more about s corp vs llc

Difference Between Incorporation and Corporation

Incorporation is the process of making a business into a corporation. You have to fill out the right forms, pay the right fees, and follow all the rules in order to create a separate legal entity. When the process of incorporating a business is over, that business is now a corporation. It can own things, make deals, pay taxes, and stay in business even if the owners change.

What Is Incorporation?

Incorporation is the process of making your business a separate legal entity from you by officially registering it with the government. After this is done, the law sees the business as a separate person.

This is important because incorporation gives you important protections and benefits:

-

If a business owes money or is being sued, your personal belongings, like your home, car, and savings, are usually safe.

-

The business can buy things, open a bank account, sign contracts, and pay taxes in its own name.

-

Even if the owners change, the business can still run.

Many businesses that are incorporated use "Inc." or "Corp." in their names. For example, the name SK Financial CPA Inc. means that the business is a corporation that was created through the process of incorporation.

Benefits of Incorporation

People choose to incorporate their business because it brings several important advantages:

1. Liability Protection

If the business is sued or owes money, your personal things like your house, car, and savings are usually safe. You are not personally responsible for the company's debts.

2. Easier to Raise Money

A business that is incorporated can get money by selling shares to investors. This makes it easier to get money for growth and expansion.

3. Increased Credibility

People who work with you, like clients, partners, and investors, may think that incorporated businesses are more professional and trustworthy. This can lead to more business.

4. Long-Term Stability

Even if the owner of a business changes, the business can still run. Customers, employees, and investors can all feel good about this stability.

What Is a Corporation?

After you finish the incorporation process, the business is now a legal corporation. It runs itself and has its own rights and duties, separate from the people who own it. It can enter into contracts, own things, pay taxes, and go to court. The people who own the company are called shareholders. A board of directors runs the company and owns the assets.

Types of Corporations

There are several main types of corporations in the U.S., and each one has its own rules for taxes, purposes, and benefits.

1. C Corporation

A C corporation must pay taxes on its profits before it can give money to its shareholders. The owners of other kinds of corporations pay taxes on the money the business makes. This kind of business can have as many shareholders as it wants, which makes it a good choice for big companies or ones that want to go public. There are a lot of shareholders and a lot of business for C corporations like Apple and Microsoft.

2. S Corporation

An S corporation doesn't have to pay taxes on its profits and losses twice because it gives them to its shareholders, who then report that income on their own tax returns. There are some rules, such as that only certain people can own shares and that there can't be more than 100 shareholders. It works well for a lot of small and medium-sized businesses, though. A family-run construction business with ten shareholders might want to become a S corporation so they don't have to deal with complicated tax issues and are still safe from being sued.

3. Nonprofit Corporation

A nonprofit corporation is not for making money for its owners. Instead, it is set up to help people in need, teach them, or do something good for the community. These groups might be able to get tax-exempt status, which means they don't have to pay federal income taxes on the money they raise to help their cause.

Why is there Confusion in Incorporation vs Corporation?

The difference is important in legal and financial situations. Incorporation means filing paperwork with the state, like the Articles of Incorporation, paying state fees (which can be anywhere from $50 to more than $500), and following state-specific rules. The end result is a corporation, which is a registered business that can now sign contracts, own things, and pay taxes in its own name.

Putting them in the wrong order on official forms, tax returns, or business contracts can lead to expensive mistakes. For instance, if you call a process an entity in a legal contract, it could cause delays or even cause the state to reject the filing.

Comparing Incorporation vs Corporation

|

Feature |

Incorporation (Process) |

Corporation (Entity) |

|

What it is |

The legal process of starting a business by filling out state-required forms like Articles of Incorporation |

The state approves the business entity that exists after incorporation. |

|

Key Forms |

Articles of Incorporation (the names of these documents vary by state), an Initial Report, and sometimes an IRS Form SS-4 for an EIN |

Annual Reports, IRS Form 1120 (for C corps), or 1120-S (for S corps) are examples of ongoing forms. |

|

Timing |

Once done, it can take 3 to 10 business days in most states to finish (rush filings may take 24 hours). |

It stays in place until it is legally dissolved or administratively closed. |

|

State Fees |

$50 to $500, depending on the state. Filing quickly may cost more. |

State fees for reports and renewals each year (on average, $50 to $400) |

|

Purpose |

To legally create a new company and give it its own legal status |

To work as a separate legal business with its own rights, duties, and responsibilities |

|

Example |

Filing Articles of Incorporation in Florida costs $70. |

Bright Ideas Corp. is filing its annual report and paying $150 to stay in good standing. |

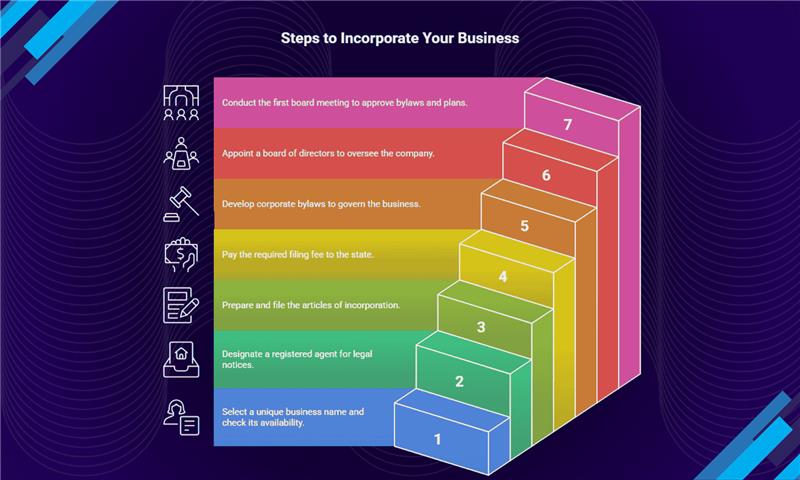

Steps to Incorporate Your Business

The steps that most businesses follow are the same, but the exact process may be a little different in your state.

1. Choose a Unique Business Name

Pick a name that isn't already taken by another business in your state. Most states let you check availability online, and some even let you reserve the name for a small fee before you file.

2. Select a Registered Agent

Your company's legal notices and official mail will go to a registered agent. This could be you, someone who works for you, or a company that registers agents.

3. Draft and File Articles of Incorporation

This is the most important paper that starts your business. It usually has:

-

Your company’s name and address.

-

The purpose of your business.

-

Details about your stock (if you plan to issue any).

-

Information about your registered agent.

You file this with your state’s business office, either online or by mail.

4. Pay the Filing Fee

The cost depends on your state some are under $100, while others can be several hundred dollars. This is a one-time fee when you first incorporate.

5. Create Corporate Bylaws

The bylaws are like the rules for your business. They go over important rules like how decisions are made, how meetings will be run, who can vote, and more. They can help you stay organized, even if your state doesn't require them.

6. Appoint a Board of Directors

Most companies need at least one director, but bigger ones often have a group of directors. The board makes important decisions and keeps an eye on where the company is going.

7. Hold the First Board Meeting

The board officially approves the bylaws, gives out shares of stock, and makes the company's plan for how it will run at this meeting.

When the state checks your papers and gives them the go-ahead, your business becomes a corporation, which is a legal entity that is not you.

What Happens After Incorporation?

A lot of business owners think that incorporation is the end goal, but it's really just the beginning. Once your corporation is set up, you have to file annual reports, keep good records of meetings, hold regular meetings with shareholders and the board, and pay taxes to both the state and the federal government. You could be fined or even lose your business status if you don't do these things.

Advantages of Running a Corporation

There are a lot of great things about owning a business. Most of the time, it protects your personal assets if the business has debts or legal problems because it limits how much you can lose. Investors may be more likely to give you money if you sell stock. A business can also help your professional image by making your company look more established and trustworthy. It also gives the business continuity, which means it can keep going even if the people who started it leave.

Disadvantages of Running a Corporation

You have to do more paperwork and stay in compliance, which means you have to keep records and file them on time. There are also ongoing costs, like fees for starting a business, legal services, and other things. C corporations can also be taxed twice. This means that the business pays taxes on its profits, and then the shareholders pay taxes again on the dividends they get.

Common Misunderstandings

Misunderstanding 1: Incorporation and corporation mean the same thing.

Many people think these words mean the same thing, but they don't. Incorporation is the legal process of starting a business. A corporation is the name of the business that comes out of that process. It's not a big deal to mix them up in everyday speech, but using the wrong word in legal documents, tax returns, or contracts can cause problems or delays.

Misunderstanding 2: Only big companies need to incorporate.

Some people believe that only big, well-known companies can become corporations. Every month, thousands of small businesses turn into corporations to protect the owner's personal property, get funding, and build trust. Even a small store run by a family can benefit from being a corporation.

Misunderstanding 3: Incorporation is something you do once and forget about.

The paperwork is only the first step. To keep your corporation in good standing, you have to do things like file annual reports, pay renewal fees, keep track of meetings, and follow the rules of the corporation. If you don't follow these rules, the state could fine you or even close your business.

How to Decide If a Corporation Is Right for You

If you want to protect your personal assets, bring in investors by selling shares, or have a business that can keep going after you leave, a corporation might be the best choice for you. This structure is often a good fit for businesses that want to grow, take on bigger projects, or build stability over the long term.

If you run a small business by yourself and want to keep things simple, an LLC or a sole proprietorship might be better for you. These choices are usually easier to set up and run because they have fewer rules and ongoing requirements.

How SK Financial Can Help

Understanding Incorporation & Corporation is only the first step. Actually going through the process choosing the right structure, filing the correct forms, and staying compliant year after year can feel difficult. That’s where SK Financial makes things simple.

Our incorporation service is designed to be both fast and affordable. For only $299, you get expert CPA guidance, all the essential filings, and personalized support at a cost that’s 300% more affordable and 200% faster than many well-known providers like LegalZoom or traditional law firms. We handle everything, from filing your Articles of Incorporation and applying for your Federal Tax ID to assisting with S corporation elections and Beneficial Ownership Information Reports.

With SK Financial, you can expect your business to be incorporated in as little as 3–5 days (and in some cases within 24 hours) instead of waiting a week or more elsewhere. We back our work with an accuracy guarantee and even pay for any mistakes we make. You’ll also get access to our CPA resource library, a secure online portal, and year-round support to keep your corporation in good standing.

Whether you’re starting a regular corporation, forming an LLC, or setting up a nonprofit, we have clear, fixed pricing and a proven process. For nonprofits, we can also handle your tax-exempt application, starting at $499 plus the IRS fee.

And the best part you can start with a free consultation to discuss your goals and get advice on the right entity type for your needs. From there, we take care of the heavy lifting so you can focus on building your business.

Conclusion

Incorporation is the process that makes your business official, while a corporation is the legal company that exists after that process is done. It's not enough to just know the right words to tell the difference. It helps you keep your personal property safe, make better business decisions, find the right investors, and set your business up for success in the long run. If you learn the basics now, you can save time, money, and stress later.

FAQs

1. Can you have a corporation without incorporating?

No. Incorporation is the legal step that creates a corporation. Without going through that process, your business isn’t officially a corporation.

2. How long does incorporation take?

It depends on the state. Some states can approve it in just a few days, while others might take a couple of weeks.

3. Is an LLC the same as a corporation?

No. An LLC is a different type of business structure with its own rules for taxes and management.

4. Do corporations pay more taxes?

Sometimes. C corporations can face double taxation once on the company’s profits and again when those profits are paid to owners as dividends. S corporations don’t have this issue.

5. Can a corporation have just one owner?

Yes. In many states, a single person can own and run a corporation.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.