Small Business Taxes For Beginners? Detailed Guideline

Small business taxes are the federal, state, and sometimes local taxes you must file. Learn about filing as a sole proprietor, partnership, C corporation, or self-employed.

Read MoreWhen are Taxes Due 2025: Everything you need to know

The main due date for filing your federal income tax return in 2025 is Tuesday, April 15, 2025. That’s the big deadline for most individual taxpayers in the U.S.

Read MoreEducation Credits: A Comprehensive Guide For 2026

Education credits reduce your tax obligation dollar-for-dollar, they cut the amount of tax you must pay. AOTC is for undergraduate students, and the LLC is for graduates.

Read MoreWhat is the Key Difference Between a Deduction and a Credit?

Tax Credits reduce the amount of tax owed, providing a dollar-for-dollar reduction. The total amount of income that is due to taxes is decreased by a tax deduction

Read MoreWhat Are Pre-Tax Deductions and Contributions

Pre-tax deductions are funds employers remove from an employee's gross pay before withholding taxes. These deductions will lower an employee's taxable income.

Read MoreTrump Tax Plan 2025: Everything You Need to Know

Making the tax cuts implemented in the 2017 TCJA permanent top goal of the Trump Tax Plan 2026. Major change is the removal of federal taxes on Social Security income.

Read MoreSole Proprietorship Taxes in the U.S: What You Need to Know?

Sole proprietorship is the simplest business structure, where you and your business are legally the same entity. Learn how sole proprietors are taxed, what forms to file.

Read MoreHow to file back taxes? Why You Should File Back Taxes

File back taxes the IRS usually requires filing up to six years of missing tax returns. Learn how refunds, back taxes, and good-faith filing affect IRS relief options.

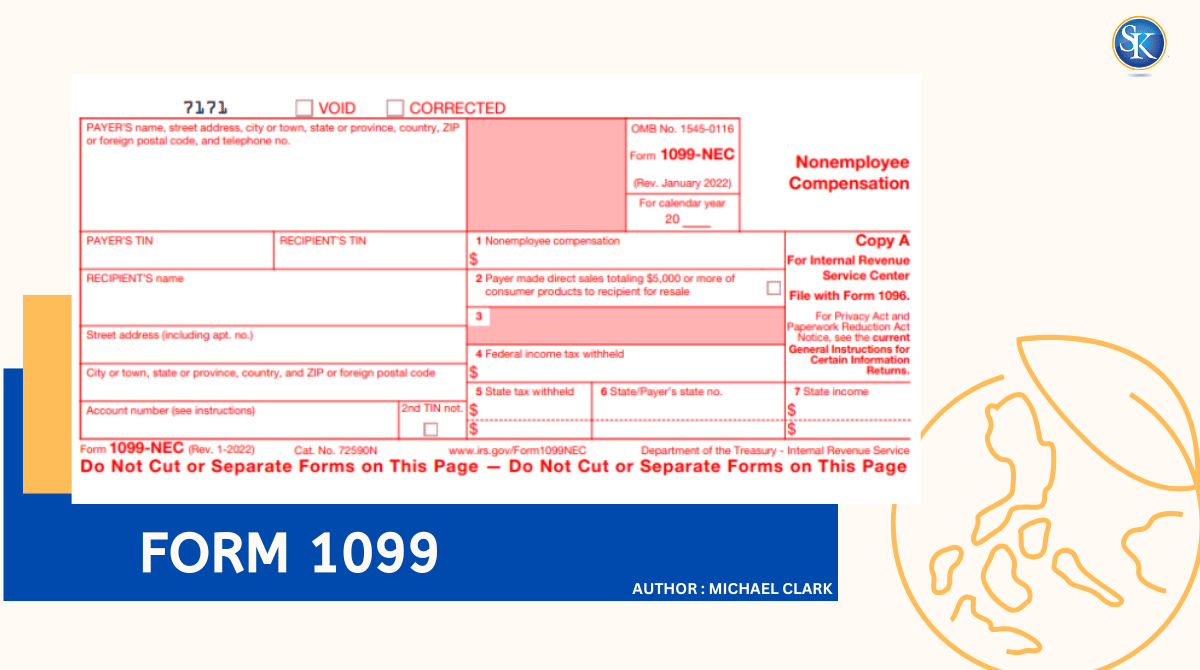

Read MoreHow to issue a 1099? Common Mistakes to Avoid

Not every payment requires a 1099. Learn when you don’t need to issue one, including credit card payments, third-party platforms, corporations, and goods-only purchases.

Read MoreWhy Might Preparing Taxes be Different For People Living in Different States?

Preparing taxes might be different for people living in different states because tax laws and rates are different by state. Preparing taxes can be different depending on where you live.

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us