Why Are Taxes Due in 2026 in the USA, Tampa, Florida?

April 15, 2026, is the official due date in the U.S. for taxes due in 2026. This is the last day you can file your tax return and pay any taxes you owe on money you made in 2025

Read MoreNo Tax On Overtime: Detailed Guideline

Discover the No Tax on Overtime deduction. eligibility, rules, and savings for workers and employers, plus payroll compliance and planning tips.

Read MoreWhat Types of Income can you use in Retirement to support yourself?

Discover the main types of retirement income. Social Security, pensions, 401(k)s, IRAs, annuities, investments & rental income to secure your future.

Read MoreWhat is Reimbursement Meaning? Tax Rules About Reimbursement

Discover the meaning of reimbursement in business and taxes. Learn types, IRS rules, and how proper records keep finances and tax returns accurate.

Read MoreHow Long to Keep Tax Records? Step-by-step guideline

How long to keep tax records? IRS generally recommends keeping tax records for three years, but in some situations you may need to hold on to them for 6 six years

Read MoreWhat tax relief services are, and how they work?

Know what tax relief services are, how they work, and the options available to reduce IRS debt, penalties, and stress while protecting your finances

Read MoreComprehensive Guide to Child Support Tax Credit

How child support affects your taxes? Learn the IRS rules on child support, tax credits, and deductions. Understand Child Tax Credit, custody rules, and how to maximize your refund.

Read MoreWhat Is a Private Foundation? Benefits of a Private Foundation

Learn how private foundations work, their tax benefits, rules, and lasting impact. Discover if starting one is right for you, your family, or business.

Read MoreHow to Avoid Tax on a Savings Account

Explore effective ways to reduce or avoid taxes on your savings account. Smart strategies to maximize interest earnings and keep more of your money

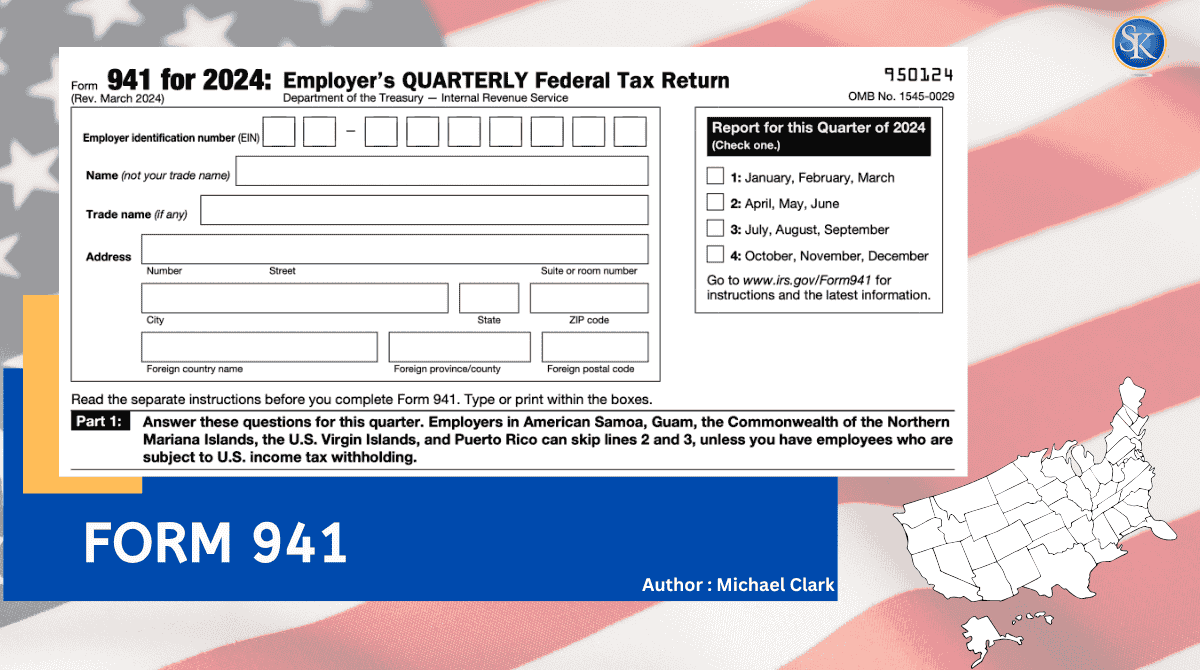

Read MoreWhat Is Form 941? Who Needs to File Form 941?

Form 941 is the one IRS form you can't afford to skip if you have employees. It's the quarterly tax form that shows how much federal income tax, Social Security, and Medicare.

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us