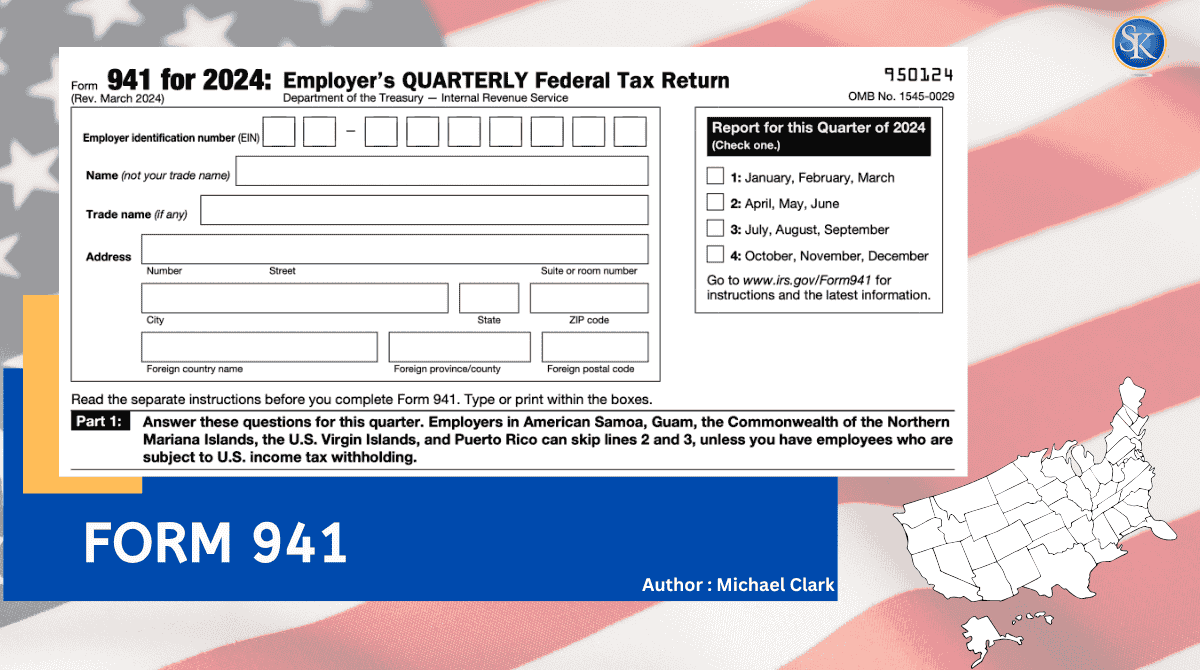

What Is Form 941? Who Needs to File Form 941?

Form 941 is the one IRS form you can't afford to skip if you have employees. It's the quarterly tax form that shows how much federal income tax, Social Security, and Medicare you have withheld and paid. This helps your firm stay in compliance. Form 941 may look like a regular form, but it is one of the most important tax duties for companies. This form helps you keep track of your payroll taxes, and if you don't fill it out, you could be in trouble. It doesn't matter if you're just starting to hire people or are managing a growing company.

What Is Form 941?

Employers use Form 941 every three months to tell the IRS how much they owe in payroll taxes. As an employer, you are in charge of taking off certain taxes from your employees' paychecks, such as federal income tax, Social Security, and Medicare. But as the employer, you also have to pay your part of the Medicare and Social Security taxes.

You need to fill out Form 941 to disclose all of it. It tells the IRS how much tax you took out of your employees' paychecks, how much you owe as the employer, and how much you've already paid. Think of it as a quarterly meeting with the IRS to show that you are doing your payroll taxes correctly.

Who Needs to File Form 941?

If you run a business and pay employees, there’s a good chance you need to file Form 941. It doesn’t matter if you’ve hired one person or a full team if you’re withholding taxes from their paychecks, the IRS expects this form from you every quarter.

There are a few exceptions:

-

Seasonal businesses might not need to file Form 941 every quarter only for the quarters when they actually pay wages.

-

Very small employers those who owe less than $1,000 in payroll taxes for the whole year might be allowed to file Form 944 just once a year instead.

-

If you’re a household employer (like hiring a nanny) or a farm employer, you’ll use different forms altogether.

But for most small and mid-sized businesses, Form 941 is the standard way to report payroll taxes every three months.

What Does Form 941 Report?

Form 941 is like a summary of your payroll tax activity for the quarter. It shows the IRS how much federal income tax you took out of your employees’ paychecks, how much Social Security and Medicare tax you withheld, and how much you paid as the employer.

It also includes things like adjustments for sick pay or tips, any tax credits you’re claiming, and how much money you’ve already sent to the IRS. If you still owe anything (or if you overpaid), the form helps sort that out too. It might seem like a lot, but once you understand each part, it becomes easier to manage every quarter.

Here’s a quick look at what’s included:

|

What It Reports |

What That Means |

|

Federal Income Tax Withheld |

The taxes you took from employee paychecks for federal income tax |

|

Social Security & Medicare Taxes |

Both the employee’s part (you withhold) and the employer’s part (you pay) |

|

Adjustments |

Changes for things like tips, sick pay, or group-term life insurance |

|

Tax Credits |

Credits like COVID-related sick leave or COBRA premium assistance |

|

Deposits Made |

How much you’ve already paid to the IRS during the quarter |

|

Balance Due or Overpayment |

The final amount you still owe or any extra you paid that could be refunded |

When Is Form 941 Due?

It needs to be filed every three months, so it’s due four times a year. Each deadline covers the previous quarter’s wages and taxes. Even if you’ve already paid your payroll taxes, you still have to file the form. Missing a deadline even by a few days can lead to penalties, so it’s a good idea to mark these dates on your calendar. And if a due date falls on a weekend or holiday, the IRS gives you until the next business day to file.

Here’s a quick breakdown of the due dates:

|

Quarter |

Months Covered |

Form 941 Due Date |

|

1st Quarter |

January, February, March |

April 30 |

|

2nd Quarter |

April, May, June |

July 31 |

|

3rd Quarter |

July, August, September |

October 31 |

|

4th Quarter |

October, November, December |

January 31 |

How Do You File Form 941?

There are two options when it comes to filing Form 941 you can either file it online or send it through the mail.

1. File Electronically (e-File)

The fastest and quickest way to file is online. You can e-file Form 941 using IRS-approved software, your payroll service, or a tax expert you trust. The system usually checks for typical mistakes, which helps cut down on them. You'll also get a confirmation as soon as the IRS gets it. This is the plan that most businesses employ since it works quickly, well, and safely.

2. File by Mail

You can mail Form 941 if you want to file on paper. The IRS will take physical copies, but where you send them depends on where your firm is located and if you are sending a payment. The IRS has a complete list of mailing addresses for each state. Just make sure you're sending it to the appropriate spot so it doesn't get delayed.

No matter what you choose, make sure everything is correct and filed on time. You could still get in trouble if you don't file the form, even if you've already paid your payroll taxes. It's always better to arrive early than to have to pay late fees later.

What Happens If You Miss the Deadline?

Missing the Form 941 deadline can cost you. The IRS charges penalties if you file late, don’t pay on time, or both. You could get hit with a 5% fee for each month it’s late (up to 25%), plus interest and extra charges if you owe taxes. It might not seem like a big deal at first, but those costs add up quickly. That’s why it helps to set calendar reminders or let a tax pro keep track just to be safe and stress-free.

Common Mistakes to Avoid with Form 941

Things like simple math errors, forgetting to sign the form, or using the wrong version for the quarter happen more often than you’d think. Many people also forget to report employee tips or don’t match what they say they paid with what was actually deposited. These little slip-ups can delay processing or even trigger IRS notices so double-check everything before you file.

Conclusion

This form shows how your business keeps payroll taxes accurate and up to date every quarter. It shows what you’ve withheld, what you’ve paid, and helps keep everything clear between you and the IRS. Filing it on time isn’t just a rule it protects your business from late fees and reporting issues. Review your payroll, match your deposits, and make sure the form reflects everything properly. It’s a small step that goes a long way in keeping your business on track

FAQs

1. Do I have to file Form 941 if I have no employees for the quarter?

If you didn’t pay any wages during the quarter, you still need to file Form 941 just enter zeros. This tells the IRS you didn’t skip it by accident.

2. What’s the difference between Form 941 and Form 944?

Form 941 is filed quarterly, while Form 944 is filed annually. The IRS decides which one you’re supposed to use based on your total payroll tax liability.

3. Can I e-file Form 941 myself?

Yes, if you have the right software or use an IRS-approved provider. Many small businesses let their payroll provider handle it.

4. What if I switch payroll providers mid-quarter?

You can still file Form 941, but you need to make sure that all salaries and taxes are reported in both systems.

5. Can I pay my 941 taxes with the form?

No, not really. The Electronic Federal Tax Payment System (EFTPS) is usually used to make payments separately. If you're a small business owner, though, there could be a method to include payment via check.

6. How do I know if the IRS received my Form 941?

You will get a confirmation if you e-file. If you sent it by mail, the best thing to do is to keep an eye on its delivery and your IRS account for developments.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.