Why do I owe taxes this year 2026?

Why do I owe taxes this year? Learn about changes in income, withholding, tax credits, and more that could be behind your 2025 tax bill and how to avoid it

Read MoreCalifornia Tax Refund: Check your tax Refund Status

A California tax refund is the money you get back when you’ve paid. You can track your refund easily using the FTB’s online tool

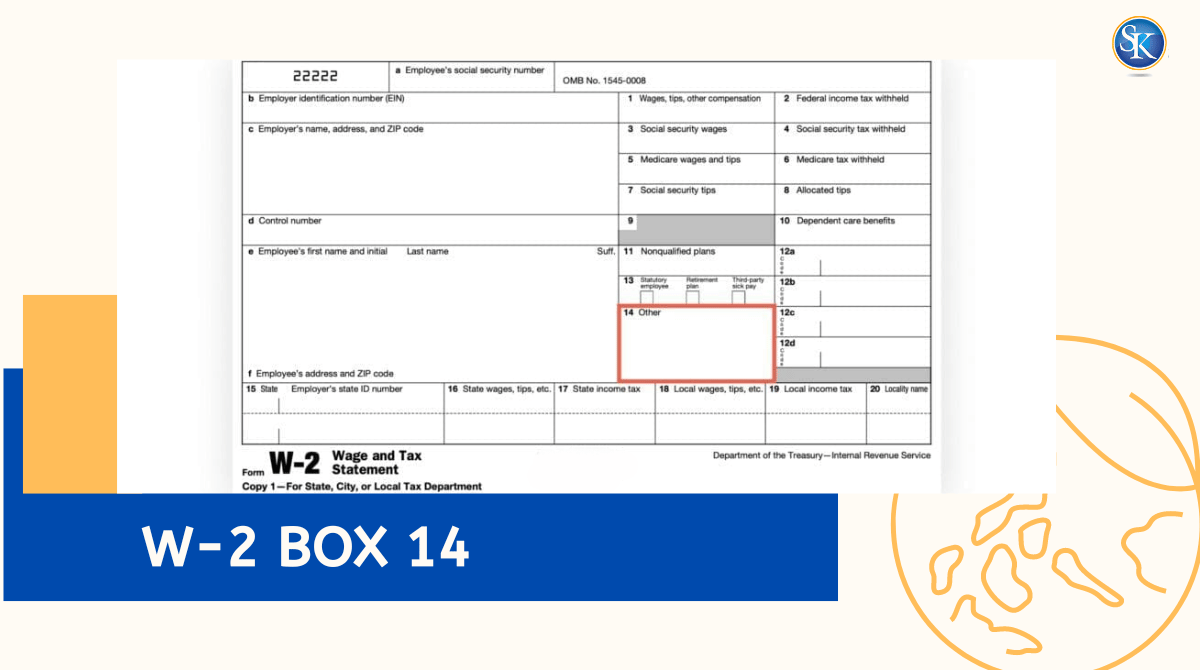

Read MoreW-2 box 14 codes: Detailed W-2 box 14 codes list

There is no fix standred codes for W2 box-14 the feral government doesn't provide standardized codes for w2 box 14 codes items, employers can list any description they choose.

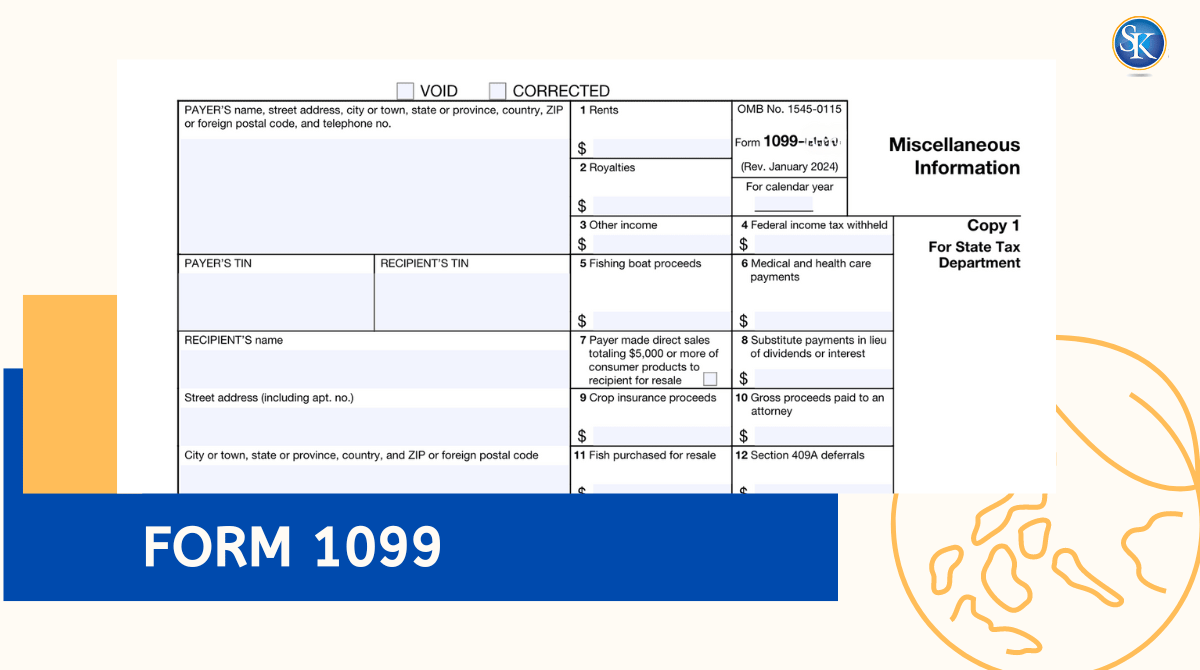

Read MoreForm 1099 : How It Works, Who Gets One

1099 form is an IRS information return used to report various types of non-wage income such as freelance earnings, dividends, interest, or rent. It ensures all income sources are properly reported and taxed.

Read MoreWhat Is Financial Accounting and Why Does It Matter?

Financial accounting is called the language of business because it communicates financial results to people outside the company such as investors, lenders, and regulators

Read MoreWhat is Modified Adjusted Gross Income? step-by-step-guide

Modified adjusted gross income is your adjusted gross income plus items the IRS adds back such as tax exempt interest selected foreign income and some deductions.

Read MoreAmended Tax Return status? How to file an Amended Tax Return

Learn how to file amended tax returns and check amended tax return status. Get insights into the process and guidelines for amending tax returns

Read MoreWhat is Gross Income? The formula and how to calculate it

Gross income is the total amount of money you earn before any deductions such as taxes, retirement contributions, or insurance premiums.

Read MoreWhat is 401(k) tax form? Here's everything you need to know

Learn about the 401(k) tax form, its importance, and how it affects your retirement savings. 401(k) tax form eligibility, contribution limits, benefits

Read MorePower of Attorney After Death: A few things you should know

Explore Power of Attorney after death: Understand implications, termination, and legal responsibilities for informed estate planning

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us