Form 1099 : How It Works, Who Gets One

Form 1099 is one of the most common IRS forms used to report income that isn’t from wages or salary like freelance work, investment earnings, or digital payment transactions. Whether you’re self-employed or earning passive income, understanding how the 1099 form works can help you stay tax compliant and avoid IRS penalties.

At SK Financial CPA in Tampa, FL, US we help freelancers, investors, and business owners handle 1099 reporting accurately and on time.

Reliable and affordable accounting services in Tampa Florida, US

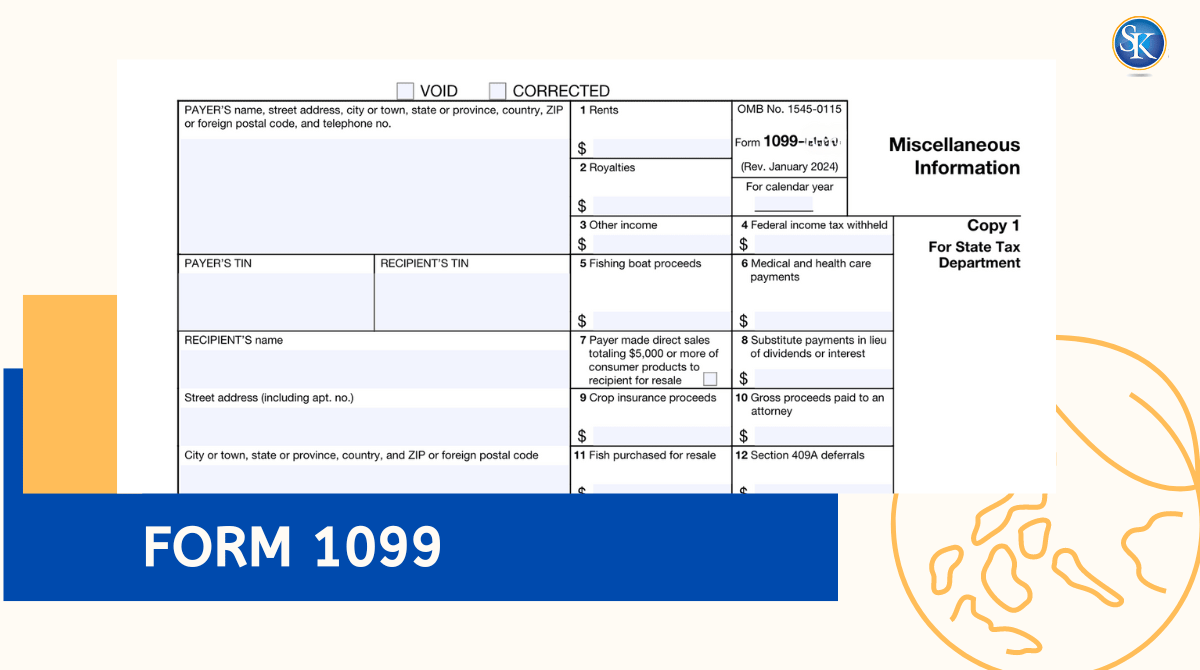

What is a 1099 Form?

A 1099 form is an IRS information return used to report various types of non-wage income such as freelance earnings, dividends, interest, or rent. It ensures all income sources are properly reported and taxed.

For example, a freelancer who earns $800 from a client or a landlord who collects $1,000 in rent both receive a 1099 form for that income.

You can check here: All important tax forms

Who Receives a 1099 Form?

You’ll receive a Form 1099 if you’ve earned income outside of regular employment. This includes:

-

Freelancers and independent contractors earning $600 or more.

-

Investors earning interest or dividends.

-

Individuals paid through digital platforms such as PayPal or Venmo.

-

Landlords collecting rental income.

-

Sellers receiving proceeds from property or stock sales.

Recent IRS Updates on 1099 Reporting Thresholds

|

Tax Year |

1099-K Reporting Threshold |

|

2024 |

$5,000 |

|

2025 |

$2,500 |

|

2026 |

$600 |

These lower thresholds mean even small transactions through PayPal, Venmo, or Stripe may trigger a 1099 form.

IRS Free E-Filing for 1099 Forms

The IRS’s Information Returns Intake System (IRIS) allows free online filing for 1099 forms. Small businesses and freelancers can use it to issue 1099s quickly and reduce paper filing errors.

Top accounting firms in tampa, florida, US

Types of 1099 Forms

Here are the most common 1099 forms and what each reports:

|

1099 Form |

Purpose |

Reporting Threshold |

|

1099-NEC |

Non-employee compensation |

$600+ |

|

1099-MISC |

Miscellaneous income (rent, prizes) |

$600+ ($10 for royalties) |

|

1099-INT |

Interest income |

$10+ |

|

1099-DIV |

Dividend income |

$10+ |

|

1099-K |

Payment processor transactions |

$5,000+ (2024) |

|

1099-B |

Stock sales, barter transactions |

Any amount |

|

1099-R |

Retirement distributions |

$10+ |

|

1099-G |

Unemployment benefits, tax refunds |

$10+ |

|

1099-S |

Real estate sales |

Any amount |

Form 1099-NEC (Non-Employee Compensation)

Form 1099-NEC is used to report payments of $600 or more made to freelancers, independent contractors, or self-employed workers. Businesses must send this form to anyone they pay for services who is not an employee. If you do freelance work, your clients will send you a 1099-NEC, and you must report this income on your tax return.

Form 1099-MISC (Miscellaneous Income)

Form 1099-MISC is issued for different types of income, such as rent, royalties, prizes, legal settlements, and medical payments. Before 2020, businesses also used it for non-employee compensation, but now Form 1099-NEC covers that. If you earn at least $600 in miscellaneous income or $10 in royalties, you will receive this form.

Form 1099-K (Payment Card and Third-Party Transactions)

Form 1099-K is sent to people who receive payments through credit cards, online platforms, or payment apps like PayPal and Venmo. If your total payments exceed $25,000 in 2025 (this will drop to $600 in 2026), the payment processor must send you this form. It helps the IRS track business transactions and ensure taxes are collected on sales made through digital payment services.

Form 1099-C (Cancellation of Debt)

This form reports canceled or forgiven debt over $600, such as credit card balances or settled loans. The IRS treats canceled debt as taxable income unless an exemption applies.

Form 1099-INT (Interest Income)

Form 1099-INT is used to report interest income from banks, credit unions, or other financial institutions. If you earn $10 or more in interest from a savings account, certificate of deposit (CD), or bonds, your bank will send you this form. Even though interest earnings may seem small.

Form 1099-DIV (Dividend Income)

Form 1099-DIV reports dividends paid by companies to investors who hold stocks or mutual funds. If you earn $10 or more in dividends, you will receive this form. It also covers capital gain distributions from mutual funds or real estate investment trusts (REITs). Investors must report these earnings as they may be taxed at special rates depending on whether the dividends are qualified or nonqualified.

Form 1099-B (Stock and Investment Sales)

Form 1099-B is used to report the sale of stocks, bonds, and other investments through brokerage accounts. It also includes barter exchanges, where goods or services are traded instead of using money. This form shows the selling price and purchase cost, which helps investors calculate capital gains or losses for tax purposes. Brokers must send this form to investors to ensure accurate tax reporting.

Form 1099-R (Retirement and Pension Distributions)

Form 1099-R reports distributions from retirement accounts, such as 401(k) plans, pensions, annuities, and IRAs. If you take money out of your retirement savings, you will receive this form. Withdrawals before age 59½ may come with additional taxes and penalties.

Form 1099-G (Government Payments and Unemployment Benefits)

Form 1099-G is issued by federal and state agencies to report unemployment benefits, state tax refunds, and other government payments. If you received unemployment assistance, it is considered taxable income and must be reported. State tax refunds may also be taxable if you claimed itemized deductions in the previous year.

Form 1099-S (Real Estate Transactions)

Form 1099-S is used to report proceeds from selling real estate, such as houses, land, or commercial properties. If you sell a property, the closing agent or real estate attorney will issue this form to report the total amount received. Some home sales may qualify for a tax exemption, but sellers still need to keep records to determine if they owe taxes on their gains.

When Will You Receive Your 1099 Form?

The IRS requires companies to send 1099 forms to recipients by January 31 each year.

-

You’ll usually receive it by mail or email.

-

If you don’t get it by mid-February, contact the payer immediately.

-

Some platforms like PayPal and Robinhood also let you download 1099s directly from your account dashboard.

Key Steps to Handle a 1099 Form

Handling a 1099 form involves several important steps to ensure compliance and accuracy:

Step 1: Receive the Form

By January 31 of each year, you should receive your 1099 form if you earned at least $600 in non-employee compensation or other reportable income. If you have yet to receive it by mid-February, it's crucial to contact the issuer to request a copy. Ensuring timely receipt of the form helps you avoid delays in filing your tax return.

Step 2: Verify the Information

Carefully review the information on the form to ensure its accuracy. This includes verifying your name, Social Security number, and the income amount reported. Any discrepancies should be addressed immediately with the issuer to avoid potential issues with the IRS. Incorrect information can lead to tax complications and delays in processing your tax return.

Step 3: Report the Income

Use the information from the 1099 form to report your income on your tax return accurately. For example, if you received a Form 1099-NEC, you should report the income on Schedule C (Form 1040) if you are self-employed. This form helps you calculate your net income, which is subject to self-employment tax. Accurate reporting ensures compliance and helps you avoid penalties and interest on unpaid taxes.

Step 4: Determine if You Owe Estimated Taxes

If you earn significant 1099 income, you may be required to pay quarterly estimated taxes to avoid penalties. The IRS generally requires estimated payments if you expect to owe more than $1,000 in taxes when filing your return. Use Form 1040-ES to calculate and submit estimated payments.

Step 5: File Your Taxes

Submit your tax return to the IRS by April 15, including the income reported on your 1099 forms. Whether you file electronically or on paper, timely submission is crucial for avoiding late fees and penalties. Consider using tax software or hiring a professional tax preparer to assist with your filing, especially if you have multiple 1099 forms or complex financial situations.

Step 6: Retain Records

Keep a copy of your 1099 forms and tax returns for at least three years for your records and in case of an IRS audit. Organized records help you respond promptly to any IRS inquiries and provide necessary documentation to support your tax return. Retaining records also assists with future tax planning and financial management.

Common Mistakes to Avoid

Handling 1099 forms can be straightforward if you are diligent, but there are common mistakes to avoid:

-

Forgetting to include 1099 income on your return.

-

Mixing personal PayPal/Venmo transactions with business income.

-

Ignoring the form or filing late.

-

Mismatched SSN or name details.

-

Not keeping 1099 copies for at least 3 years.

Always match your total 1099 income with IRS transcripts via your online IRS account to ensure accuracy.

How SK Financial CPA Can Help

Our team in Tampa helps clients handle 1099 reporting, estimated taxes, and small business filings with precision. Whether you’re a freelancer, investor, or LLC owner, we ensure your taxes are filed accurately and on time while maximising legal deductions.

Conclusion

Staying organised with your 1099 forms prevents penalties and keeps your taxes stress-free. If you’re unsure about filing, reach out to SK Financial CPA for expert help.

FAQs

Can I get my 1099 electronically?

Yes. Many platforms like PayPal, Robinhood, or your employer’s payroll system offer digital downloads before mailing paper copies.

What should I do if I lose my 1099 form?

If you misplace your 1099 form, check your online account with the issuer (e.g., PayPal, banks, investment firms) as they often provide digital copies. If unavailable, contact the issuer to request a duplicate. If you still can’t obtain the form, report the income based on your records and inform the IRS when filing your tax return.

What should I do if I don’t receive my 1099 form by January 31?

If you have yet to receive your 1099 form by mid-February, contact the issuer to request a copy. It's important to have all the necessary forms before filing your tax return to ensure accurate reporting.

Can I file my taxes without a 1099 form?

Yes, you can file your taxes without a 1099 form, but you must still report all income accurately. If you haven't received the form, use your records to report the income. Failure to report all income can result in penalties and interest.

What happens if the information on my 1099 form is incorrect?

If the information on your 1099 form is incorrect, contact the issuer immediately to request a corrected form. Accurate information is crucial for proper tax reporting and avoiding issues with the IRS.

Do I need to pay taxes on all income reported on 1099 forms?

Yes, all income reported on 1099 forms is generally taxable. However, some certain exceptions and deductions may apply. Consult a tax professional to understand your specific situation and take advantage of any applicable tax benefits.

How do I report 1099 income on my tax return?

Report 1099 income on the appropriate section of your tax return. For example, report non-employee compensation on Schedule C (Form 1040) if you are self-employed. Consult the IRS instructions or a tax professional for guidance on reporting specific types of 1099 income.

Can I receive multiple 1099 forms in a year?

Yes, you can receive multiple 1099 forms if you have multiple sources of reportable income. Each form should be reported on your tax return to ensure all income is accounted for.

What are the penalties for not reporting 1099 income?

Penalties for not reporting 1099 income can include interest on unpaid taxes, late fees, and additional penalties. The IRS can also initiate an audit to investigate unreported income, leading to further complications.

Is there a minimum amount of income that requires a 1099 form?

Generally, a 1099 form is required if you receive $600 or more in non-employee compensation or other reportable income. However, specific thresholds can vary by form type, so consult the IRS guidelines for detailed information.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.