High-Income Tax Planning Strategies

High-income tax planning is the process of organizing your income, investments, business structure, and deductions in a way that legally reduces your tax liability.

Read MoreWhat Are Tax Planning Services and Why They Are Important?

Tax planning services involve reviewing your financial situation and finding legal, IRS-approved ways to reduce how much tax you owe. This includes Income, Expenses, Investments, Retirement contributions

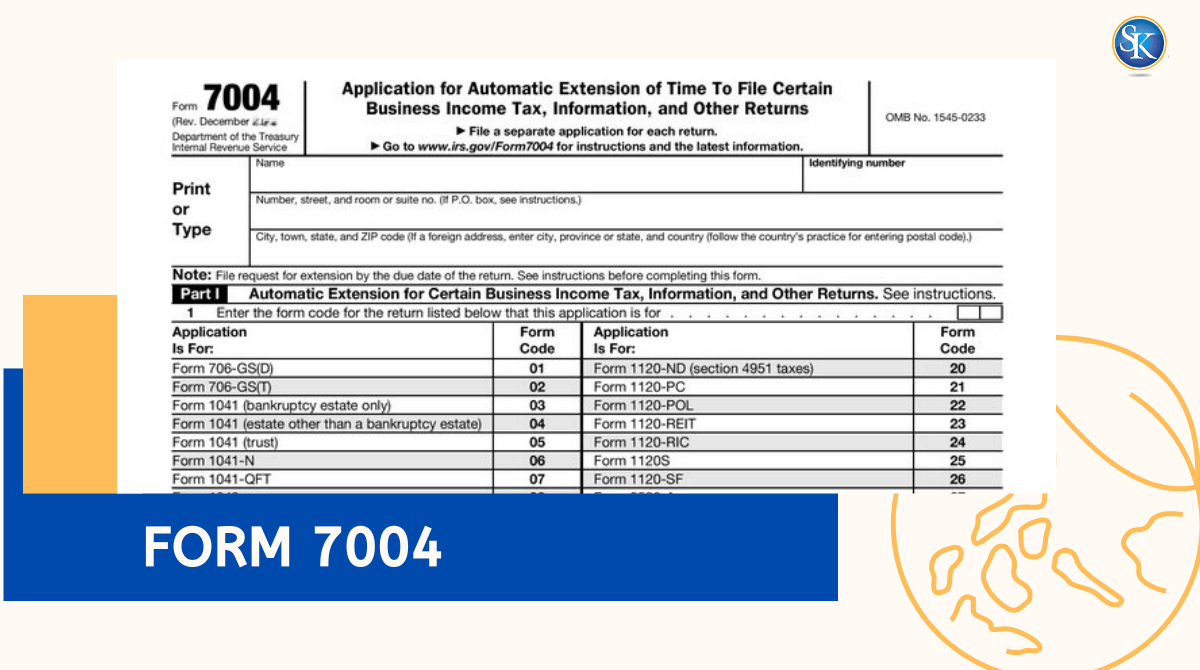

Read MoreHow to File IRS Form 7004 for Business Tax Extensions

Form 7004, “Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and allows businesses to extend the deadline for filing their tax returns.

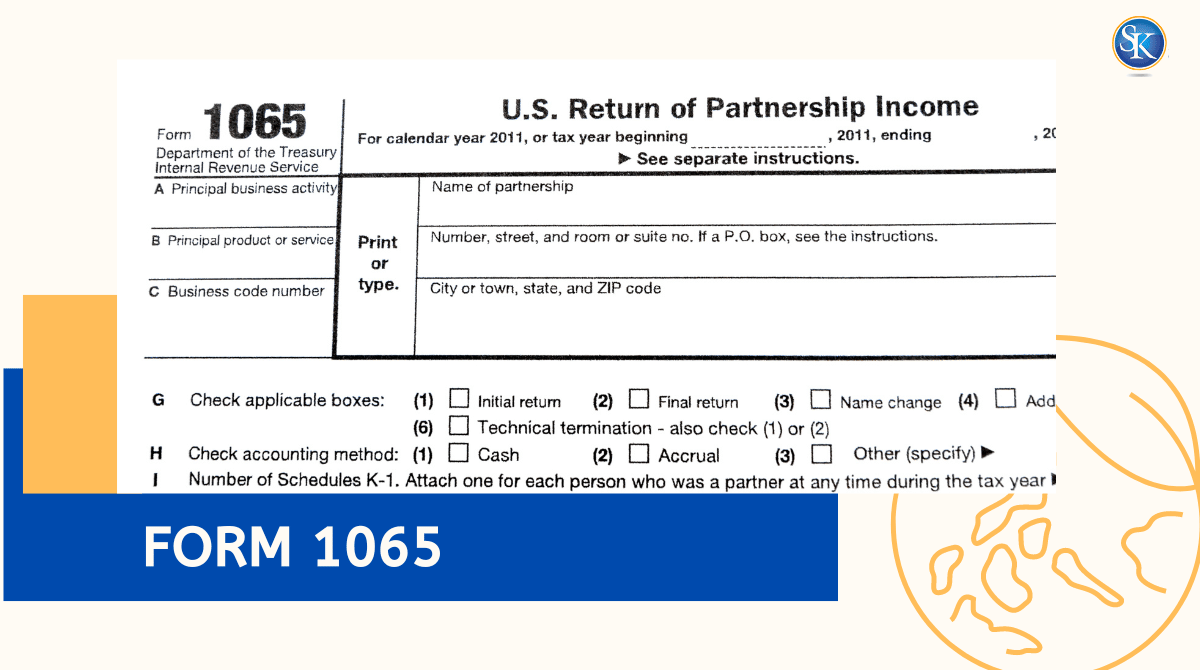

Read MoreForm 1065: Partnership Income Tax Return : Who Needs to File?

Form 1065 reports the partnership’s income, deductions, credits, assets, and liabilities. The IRS uses it to match each partner’s Schedule K-1 to their personal return

Read MoreWhat Is a W-9 Form? How to file and who can file

Information about Form W-9, This form is used to collect and confirm an individual or entity's name, address, and taxpayer identification number (TIN).

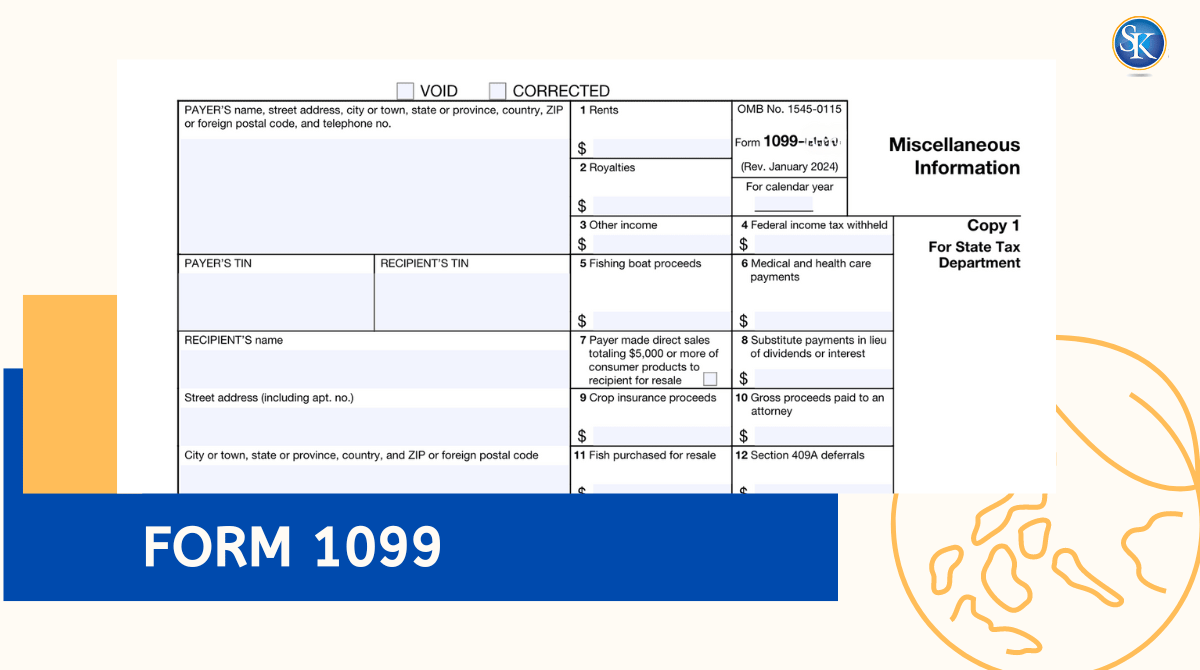

Read MoreForm 1099 : How It Works, Who Gets One

1099 form is an IRS information return used to report various types of non-wage income such as freelance earnings, dividends, interest, or rent. It ensures all income sources are properly reported and taxed.

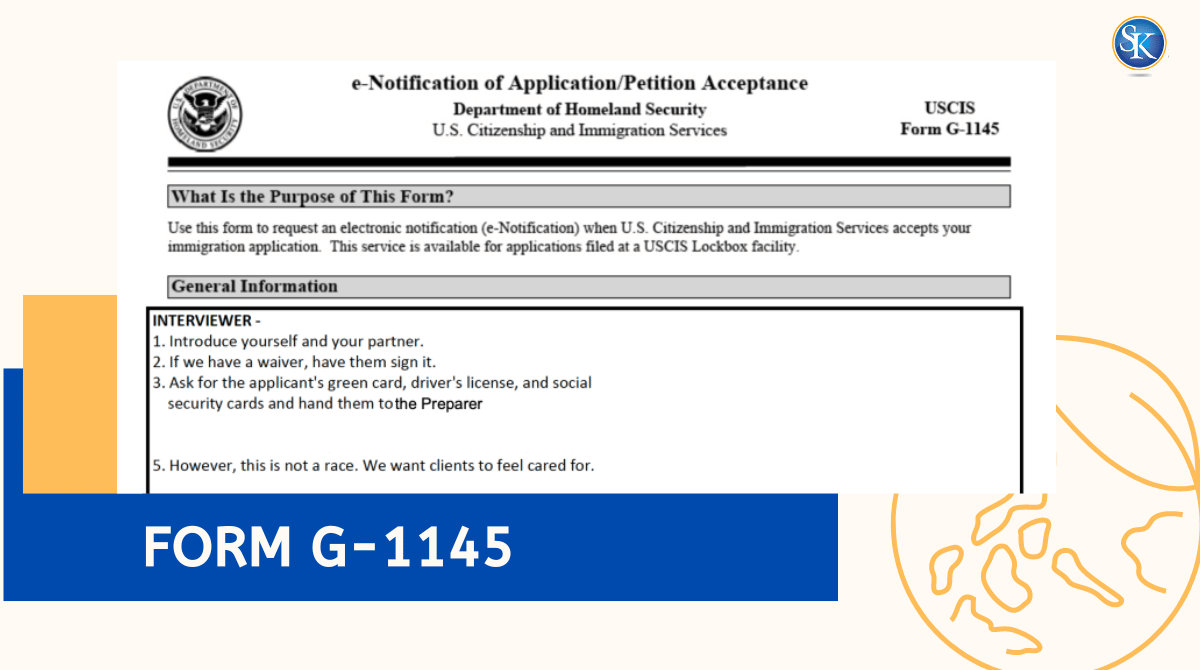

Read MoreForm G-1145: Here's everything you need to know

Form G-1145 is used to send an electronic notification to United States citizens when their immigration applications are accepted by immigration services.

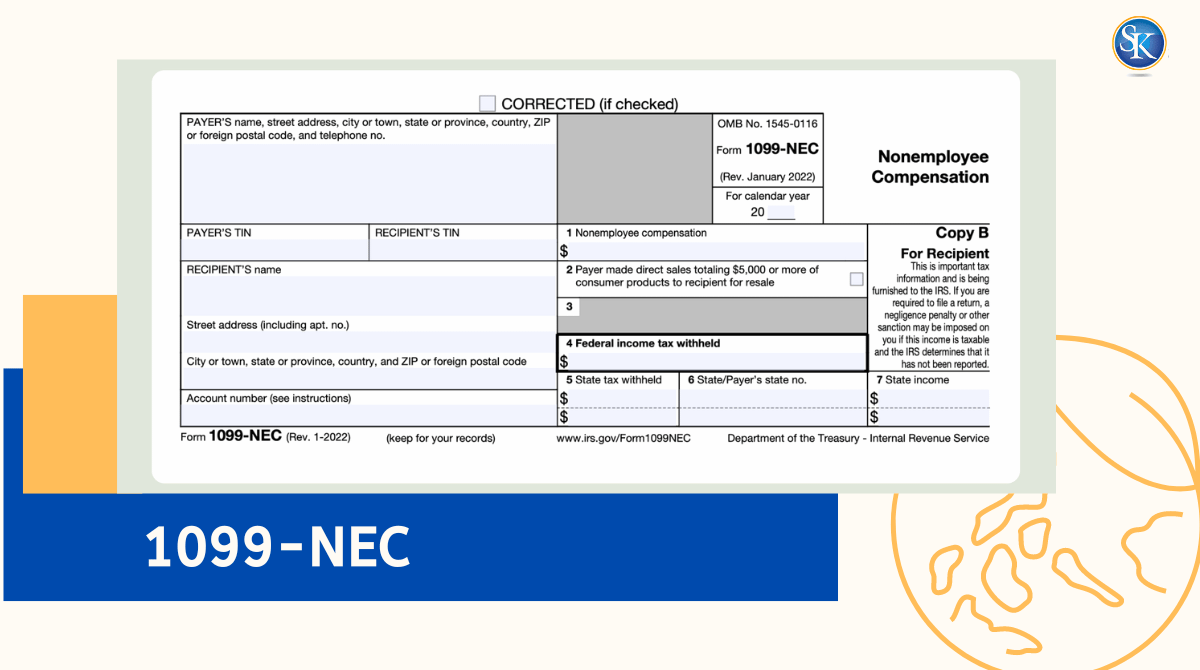

Read MoreForm 1099-NEC: What things you need to know about the Form 1099-NEC

If you have a bussiness that have totlay payment of 600$ you have to file Form 1099-NEC. Form 1099-NEC plays a crucial role for businesses and self-employed individuals

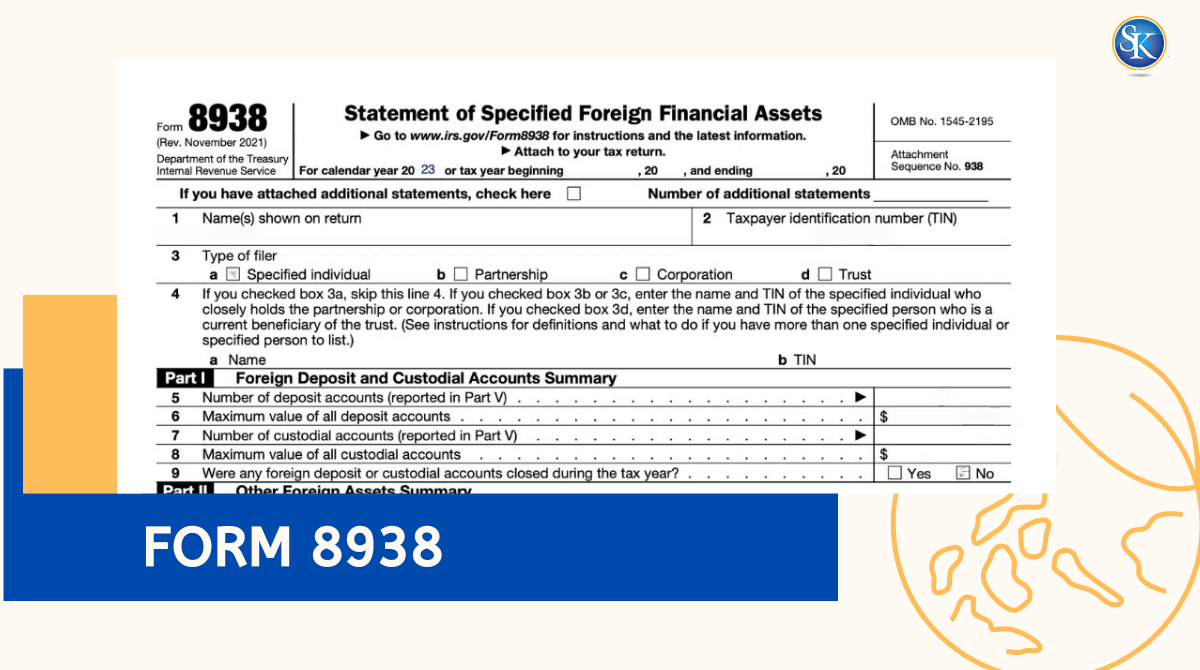

Read MoreIRS Form 8938: Who Needs to File It?

U.S. citizens, resident aliens, and certain non-resident aliens with foreign financial assets over $50K (end of year) or $75K must file IRS Form 8938.

Read MoreArizona State Income Tax: Here's everything you need to know

In Arizona, the income tax rate is 2.5%. Regardless of any other factors, taxpayers in Arizona must pay 2.5% of their previous year's income as tax.

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us