What is the Gift Tax limit for 2025-2026?

Gift tax limit for 2026 is $20,000 per person per year. This means you can give up to $20,000 to as many individuals as you want without filing a gift tax return.

Read MoreHow much does Health Insurance Cost?

Health insurance costs are not just about the monthly amount you pay to keep your plan active. Individual plans can range from $300 to $600 per month, while family plans can go well beyond $1,500 per month.

Read MoreWhy Might Preparing Taxes be Different For People Living in Different States?

Preparing taxes might be different for people living in different states because tax laws and rates are different by state. Preparing taxes can be different depending on where you live.

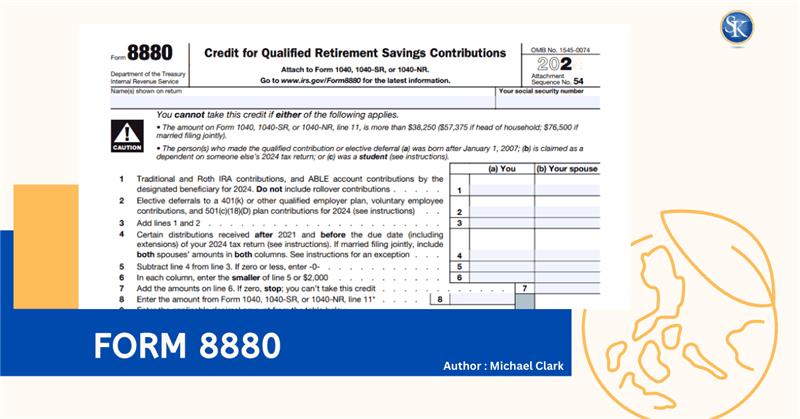

Read MoreWhat Is the IRS Form 8880? How to Fill Out Form 8880

Form 8880 allows you to claim the Saver’s Credit, a tax benefit designed to encourage low- to moderate-income taxpayers to contribute to retirement accounts.

Read MoreWhen can i file my taxes in 2025?

When can i file my taxes in 2025? You can start filing as early as January 15, 2025.If you’re expecting a refund, the earlier you file, the sooner you’ll get your money.

Read MoreRetirement Savings Contribution Credit: How it Works in 2025-2026

A retirement savings contribution credit is a special tax credit. if you contribute $2,000 to your retirement account and qualify for the 50% credit, you could reduce your tax bill by $1,000.

Read MoreWhat Is Business Accounting? And How to Manage

Business accounting involves recording money coming in, money going out, managing budgets, creating invoices, and planning for the financial future.

Read MoreChoosing the best CPA for a Startup

Choose the best CPA for your startup. Get expert advice on finding a CPA who will help your business grow, save taxes, and ensure financial success.

Read MoreWhat Is a Financial Consultant and How Do They Work?

Financial consultants advise clients on various financial matters, including budgeting, saving for big purchases, retirement planning, investing, and trusts.

Read MoreHow to Choose CPA for Small Business: Tips to Avoid Common Mistakes

small business CPA is a financial professional with expertise in handling accounting, tax, and financial planning. Explore why every small business needs a CPA

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us