How to File IRS Form 7004 for Business Tax Extensions

IRS Form 7004 lets you request an automatic extension of time to file up to six additional months. Many business owners use it to reduce stress during tax season, but it’s important to know that Form 7004 extends only the filing date, not the payment date. You must still estimate and pay any tax due by the original deadline.

Find here: Top accounting and bookkeeping services in FL, US

What Is IRS Form 7004?

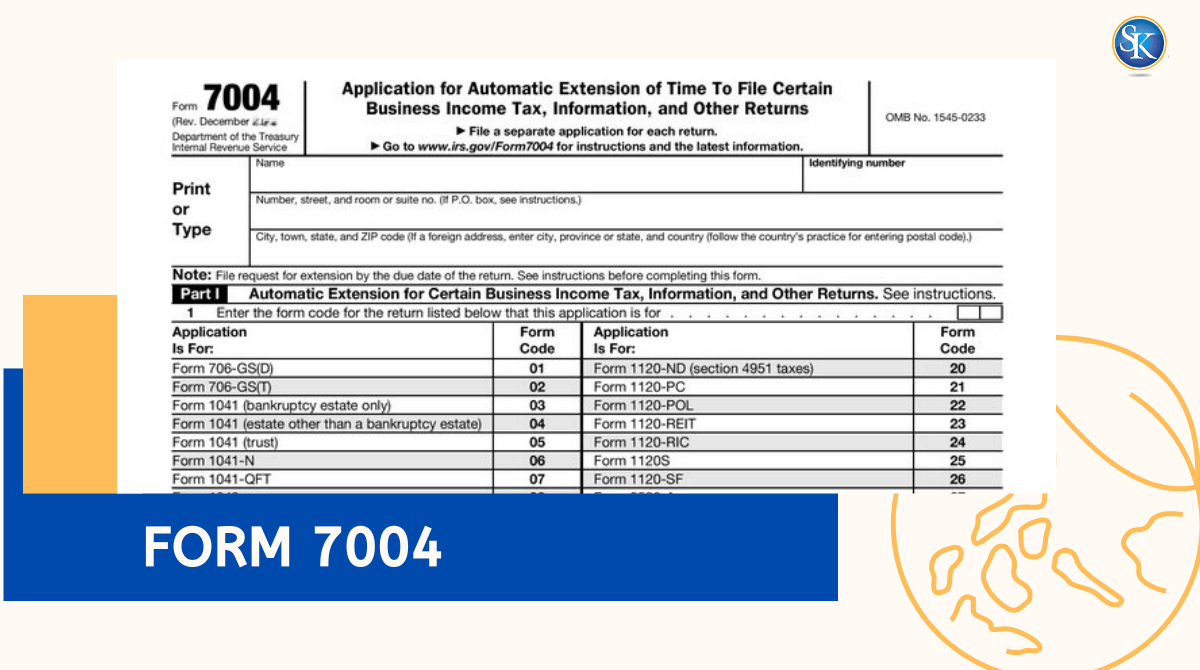

IRS Form 7004, “Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns,” lets eligible businesses request an extension for filing their tax returns.

When filed on time, it grants most businesses up to six extra months to submit their tax forms. However, it does not extend the time to pay taxes owed payments are still due on the original date.

Here you can find information about all tax forms

Who Can File Form 7004?

You can use Form 7004 if your business files one of the following returns:

-

C Corporation (Form 1120)

-

S Corporation (Form 1120-S)

-

Partnership or Multi-Member LLC (Form 1065)

-

Certain information returns listed in the IRS instructions

Note: Single-member LLCs and sole proprietors file Form 4868, not Form 7004.

Who Can File Form 7004?

You can use Form 7004 if your business files one of the following returns:

-

C Corporation (Form 1120)

-

S Corporation (Form 1120-S)

-

Partnership or Multi-Member LLC (Form 1065)

-

Certain information returns listed in the IRS instructions

Note: Single-member LLCs and sole proprietors file Form 4868, not Form 7004.

When Is Form 7004 Due? (Business Extension Deadlines)

Deadlines depend on your business structure:

|

Entity Type |

Original Due Date |

Extended Filing Due Date |

|

Partnership / S Corporation |

March 15 (15th day of 3rd month after year end) |

September 15 |

|

C Corporation |

April 15 (15th day of 4th month after year end) |

October 15 |

If the deadline falls on a weekend or federal holiday, the due date moves to the next business day.

IRS form 7004 Extension

- C Corporations that operate on a calendar year must file Form 7004 by March 15 to receive an extension. For fiscal year corporations, the deadline is the 15th day of the fourth month following the end of the fiscal year.

- S Corporations must also adhere to the March 15 deadline if they follow a calendar year. For those with a fiscal year, the form must be filed by the 15th day of the third month after the end of the fiscal year.

- Partnerships and Multi-Member LLCs must file Form 7004 by March 15 for calendar-year businesses or by the 15th day of the third month after the fiscal year ends.

Note: If the deadline falls on a weekend or holiday, the due date is extended to the next business day.

How to File IRS Form 7004 (Step-by-Step Instructions)

Step 1 – Gather Your Business Details

Collect your legal business name, address, EIN, and tax year.

Step 2 – Select the Correct Return Code (Part I)

Choose the code that matches your return type, such as 1120 for C corps or 1065 for partnerships.

Step 3 – Estimate Your Tax (Part II)

Enter your estimated total tax, any payments made, and the balance due. Pay that amount with your extension.

Step 4 – File Electronically (Recommended)

E-file provides instant confirmation and fewer errors. Paper filing is slower and must reach the IRS by the due date.

After You File – What Happens Next?

Once accepted, the IRS automatically grants your extension. Use the additional six months to:

-

Finalize your financial statements

-

Collect partner or shareholder K-1s

-

Review deductions and credits

-

Prepare an accurate return

You’ll get an electronic or mailed confirmation once your extension is approved.

Penalties and Interest for Late Payment or Filing

Even with an approved extension, the IRS can still charge penalties if:

-

You pay late 0.5 % of unpaid tax per month (up to 25 %)

-

You file late after the extended deadline 5 % of unpaid tax per month (up to 25 %)

Example: Owing $2,000 and filing 3 months late could add more than $150 in combined penalties and interest.

Myths About IRS Form 7004

Myth 1: It delays your payment deadline — False. You must still pay on time.

Myth 2: You don’t need to file if expecting a refund — False. You must still submit an extension if you can’t file by the due date.

Myth 3: Filing an extension increases audit risk — False. There’s no evidence that extensions trigger audits.

Common Mistakes to Avoid

-

Assuming Form 7004 extends the payment deadline it doesn’t

-

Entering the wrong form code for your entity type

-

Filing after the original due date

-

Underestimating tax owed and paying too little

-

Using Form 7004 when you should use Form 4868 (sole proprietor)

When to Seek Professional Help

If your business has multiple entities, foreign income, or complex ownership, a CPA can:

-

Ensure your extension is filed correctly

-

Verify your tax estimates

-

Help avoid underpayment penalties

Our CPA is specializes in business tax filings and extensions. We can review your numbers, file Form 7004 for you, and guide you on how much to pay now vs. later. Book a free consultation now.

Conclusion

Filing Form 7004 is a smart move if you need more time to prepare your business tax return. It gives you breathing room to organize records, review deductions, and avoid costly mistakes.

Remember, it only extends the filing deadline not the payment. Pay what you owe by the original due date to avoid penalties. With proper planning or help from a professional accountant, your business can stay compliant and stress-free through tax season.

FAQs

How long is the Form 7004 extension?

Up to six months for most business returns.

Can I file Form 7004 online?

Yes. E-filing is the fastest and most reliable method.

Does Form 7004 apply to payroll or excise taxes?

No. It’s for income-type returns such as Forms 1120, 1120-S, and 1065.

What if I file late?

You’ll owe both late-filing and late-payment penalties, plus daily interest.

Should I still file if I expect a refund?

Yes. File an extension if you need more time even refunds require a timely filing.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.