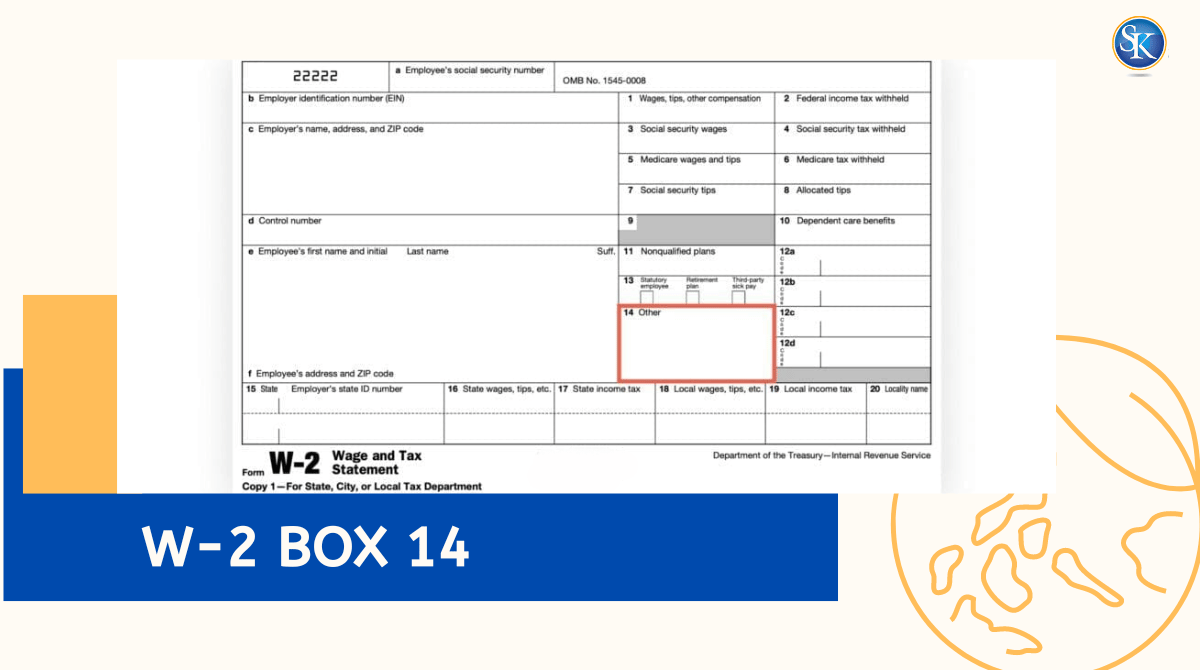

W-2 box 14 codes: Detailed W-2 box 14 codes list

W-2 Box 14 is the section of your W-2 form where employers report extra information that doesn’t fit anywhere else things like union dues, health savings contributions, tuition assistance, disability insurance, or uniform reimbursements.

In simple terms, Box 14 tells you about benefits, deductions, or payments your employer made that may or may not affect your taxes. Every employer can use it differently, so what you see listed might vary.

In this guide we’ll explain what each W-2 Box 14 code means, which ones impact your tax return, and how to handle them correctly so you can file with confidence.

Read more about w2 box 12 codes

What is W-2 Box 14?

W-2 Box 14 is an “information” box your employer uses to show extra payments, benefits, or deductions that don’t fit anywhere else on the form.

It can include things like:

-

State Disability Insurance (SDI)

-

Union dues or uniform costs

-

Health Savings Account (HSA) contributions

-

Tuition assistance or commuter benefits

Each employer can use Box 14 differently, so what’s listed on your W-2 may not look the same as someone else’s. If anything seems unclear, ask your HR or payroll department before filing your taxes.

Check here: Affordable cpa services in tampa, florida, US

Why Box 14 Matters?

Even though it’s small, Box 14 can impact how you file your taxes. It often shows deductions or benefits that help you report income accurately or qualify for tax breaks.

For example:

-

If Box 14 lists “HSA $2,000,” that means your employer contributed $2,000 to your Health Savings Account. This amount is typically not taxable and can be used for medical expenses.

-

If it lists “Uniform $250,” that might mean your employer reimbursed you for uniforms an expense you can’t deduct again.

-

If you see “Education $1,000,” that might represent tuition support that could affect your taxable income depending on program type.

Understanding these entries helps you avoid mistakes, delays, and unexpected tax bills.

afforable and very quick CPA services is tampa, florda, US

Common W-2 box 14 codes list

Employers are not required to use the same wording or codes for Box 14, so you might see abbreviations or short labels. Here’s a list of the most common W-2 Box 14 codes and what they usually mean:

|

Code / Label |

What It Usually Means |

|

SDI |

State Disability Insurance withheld from your pay (CA, NJ, NY) |

|

PFL |

Paid Family Leave contributions (CA, NY, NJ) |

|

VPDI |

Voluntary Plan Disability Insurance (CA private plans) |

|

Union Dues |

Union membership fees deducted from pay |

|

Uniform / Uniform Allowance |

Reimbursement or deduction for required uniforms |

|

Charity / Charitable |

Donations made through payroll deduction |

|

HSA |

Employer Health Savings Account contributions |

|

Transit / Parking / Commuter |

Pre-tax commuting or parking benefits |

|

Health Ins / Medical |

Employer-paid health insurance premiums |

|

FSA |

Flexible Spending Account contributions |

|

Education / Tuition |

Employer reimbursement for job-related classes |

|

Imputed Income |

Taxable value of non-cash benefits (e.g., company car use) |

|

Other |

Employer-specific or miscellaneous information |

If you see a label that’s not listed here, ask your employer what it means. Some companies use their own abbreviations or internal codes.

Does W-2 Box 14 Affect My Taxes?

It depends on what’s listed. Box 14 can include three types of information:

-

Informational Only – Items like uniform allowances or charitable donations that don’t change your tax return.

-

Pre-Tax Deductions – Contributions such as HSA or commuter benefits that lower your taxable income.

-

Taxable Benefits – Items like certain fringe benefits that must be added to your taxable income.

If you’re unsure whether something affects your return, speak to a tax professional before filing.

How to Read W-2 Box 14 in 3 Easy Steps

Step 1: Identify Each Code

List every label and amount shown in Box 14. Use the table above or ask HR for clarification.

Step 2: Check Whether It’s Taxable

Some entries reduce your taxable income, while others are only for reference. Don’t assume they all go on your return.

Step 3: Keep Records

Save your W-2 and any explanations for at least three years. These can help you if the IRS or state reviews your taxes later.

How Box 14 Works in Real Life

Example 1:

Maria’s Box 14 shows “HSA $1,500.” She knows this is her employer’s Health Savings Account contribution, so she doesn’t add it as income.

Example 2:

James’s Box 14 shows “PFL $180.” Because he lives in California, this is his Paid Family Leave contribution — useful for state filing.

Example 3:

Alex’s Box 14 lists “Imputed Income $500.” His employer gave him access to a personal-use company car, and that $500 is taxable.

Consult a Tax Professional

It's best to go to a tax professional if you're not sure how to deal with the things in Box 14. Tax laws can be difficult, and it's easy to miss something that could change your refund or cause you to make mistakes. We offer a free consultation, so you may ask questions and obtain the proper advice without feeling rushed.

Tips for Employers: Reporting Box 14 Codes

Employers must ensure that W-2 Box 14 entries are accurate, consistent, and understandable.

Here’s how to make reporting smoother:

-

Stay Updated: IRS and state reporting rules change. Review annually.

-

Use Consistent Codes: Apply the same wording for all employees.

-

Provide Explanations: Attach a short key or legend for each code.

-

Double-Check Before Filing: Confirm amounts and spelling before sending W-2s.

Doing this helps employees avoid confusion and prevents amendment requests later.

Conclusion

Box 14 may look like a small box, but it often holds big information. It lists deductions, reimbursements, and benefits that can change your tax filing and refund outcome.

Always review Box 14 carefully before filing. Knowing what each entry means ensures your return is correct, helps you avoid penalties, and keeps your tax season stress-free.

FAQs

Can Box 14 be left blank?

Yes. If there are no extra benefits or deductions to report, your employer may leave it blank.

Are all Box 14 items taxable?

No. Some, like HSA or commuter benefits, are pre-tax. Others, like imputed income, may be taxable.

What if I don’t understand a code?

Ask your HR or payroll department. Every employer can use different wording.

Can Box 14 affect my state taxes?

Yes. Certain entries, like State Disability Insurance, apply to state-level filings.

Can I deduct union dues listed in Box 14?

Sometimes. Federal tax law limits deductions for union dues, but some states still allow them. Check with a tax professional.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.