What Are Tax Resolution Services? Common Problems Tax Resolution Services

Discover tax resolution services to stop IRS collections, reduce penalties, and set up payment plans. Learn options like OIC, CNC, and more.

Read More10 Most Common Bookkeeping Mistakes And How to Avoid Them

Know bookkeeping mistakes Mixing Personal and Business Finances, Ignoring Regular Reconciliation, Forgetting to Track Small Expenses, Not Backing Up Financial Data and more

Read MoreComprehensive Guide to Child Support Tax Credit

How child support affects your taxes? Learn the IRS rules on child support, tax credits, and deductions. Understand Child Tax Credit, custody rules, and how to maximize your refund.

Read MoreWhat Is a Private Foundation? Benefits of a Private Foundation

Learn how private foundations work, their tax benefits, rules, and lasting impact. Discover if starting one is right for you, your family, or business.

Read MoreBookkeeping Services: Different Types of Bookkeeping Services

Bookkeeping services made simple, track expenses, stay tax-ready, and grow with confidence. Affordable plans from $210/month at SK Financial CPA

Read MoreHow to Avoid Tax on a Savings Account

Explore effective ways to reduce or avoid taxes on your savings account. Smart strategies to maximize interest earnings and keep more of your money

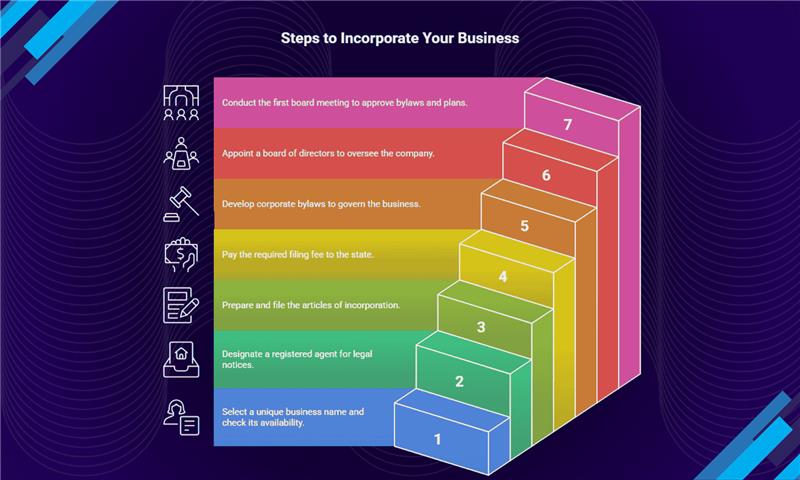

Read MoreIncorporation vs. Corporation: What's the Difference?

Learn the key differences between incorporation and a corporation. Understand their meanings, legal implications, and which is right for your business

Read MoreLLC vs S Corp: Benefits and Differences, which is better for your business?

s corp vs llc? Learn the key benefits, differences, and tax advantages of each so you can choose the best structure for your business success.

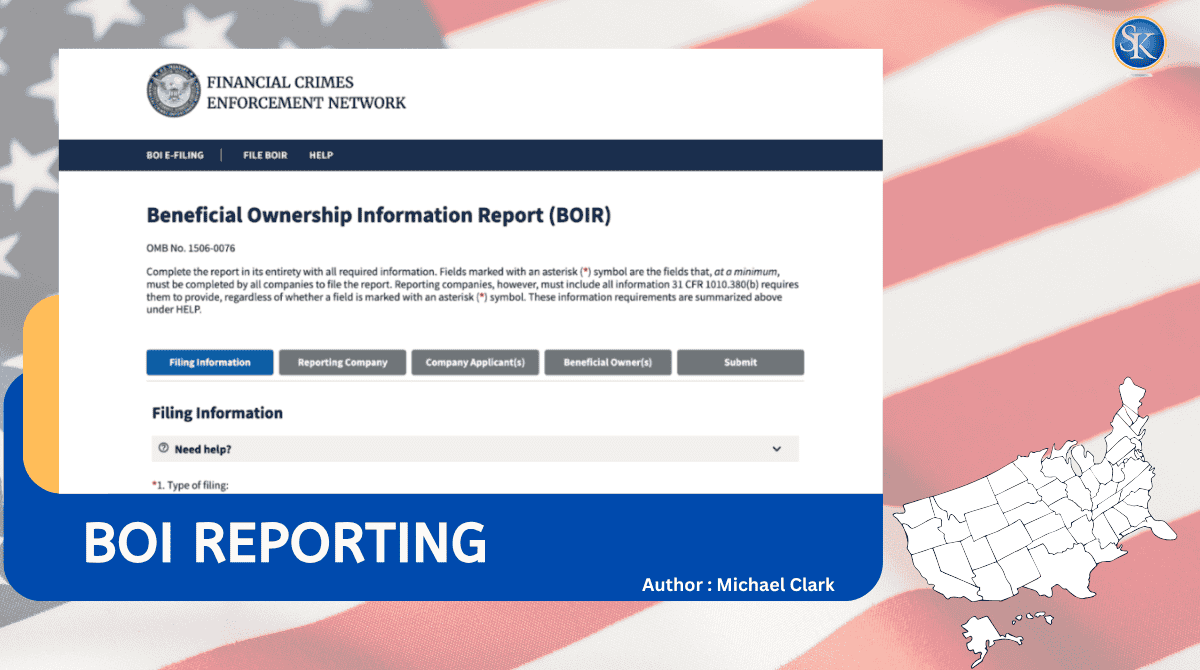

Read MoreWhat is a BOI Report? Benefit Ownership Information Reporting

Learn what the BOI Report is, who needs to file under the Corporate Transparency Act, and how Beneficial Ownership Information Reporting affects your business.

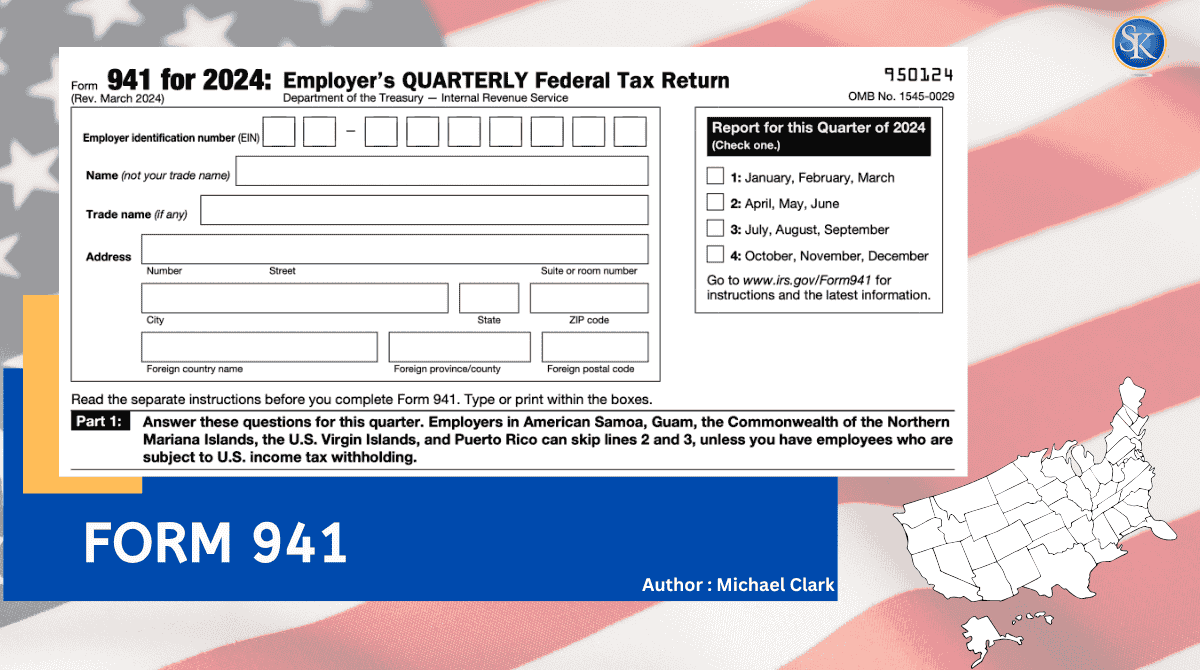

Read MoreWhat Is Form 941? Who Needs to File Form 941?

Form 941 is the one IRS form you can't afford to skip if you have employees. It's the quarterly tax form that shows how much federal income tax, Social Security, and Medicare.

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us