Why Are Taxes Due in 2026 in the USA, Tampa, Florida?

April 15, 2026, is the official due date in the U.S. for taxes due in 2026. This is the last day you can file your tax return and pay any taxes you owe on money you made in 2025

Read MoreWhat is Form 8949? How to Fill Out Form 8949

Form 8949 helps report stocks, crypto, and real estate sales to the IRS. Learn how to file, short vs long-term gains, and how it works with Schedule D

Read MoreWhat Are Tax Resolution Services? Common Problems Tax Resolution Services

Discover tax resolution services to stop IRS collections, reduce penalties, and set up payment plans. Learn options like OIC, CNC, and more.

Read MoreComprehensive Guide to Child Support Tax Credit

How child support affects your taxes? Learn the IRS rules on child support, tax credits, and deductions. Understand Child Tax Credit, custody rules, and how to maximize your refund.

Read MoreWhat Is a Private Foundation? Benefits of a Private Foundation

Learn how private foundations work, their tax benefits, rules, and lasting impact. Discover if starting one is right for you, your family, or business.

Read More10 Tax Planning Strategies to Know for 2025

Tax planning is financial planning. It’s all about managing your finances to reduce your tax bill. You’re not overpaying or missing deductions or credits.

Read MoreTax Brackets 2025 and Standard Deduction: A Step-by-Step Guide

Tax brackets 2025: There are slight increases in the income ranges for each bracket compared to 2024. In 2025, income tax rates depending on how much you earn and your filing status.

Read MoreSmall Business Taxes For Beginners? Detailed Guideline

Small business taxes are the federal, state, and sometimes local taxes you must file. Learn about filing as a sole proprietor, partnership, C corporation, or self-employed.

Read MoreWhen can i file my taxes in 2025?

When can i file my taxes in 2025? You can start filing as early as January 15, 2025.If you’re expecting a refund, the earlier you file, the sooner you’ll get your money.

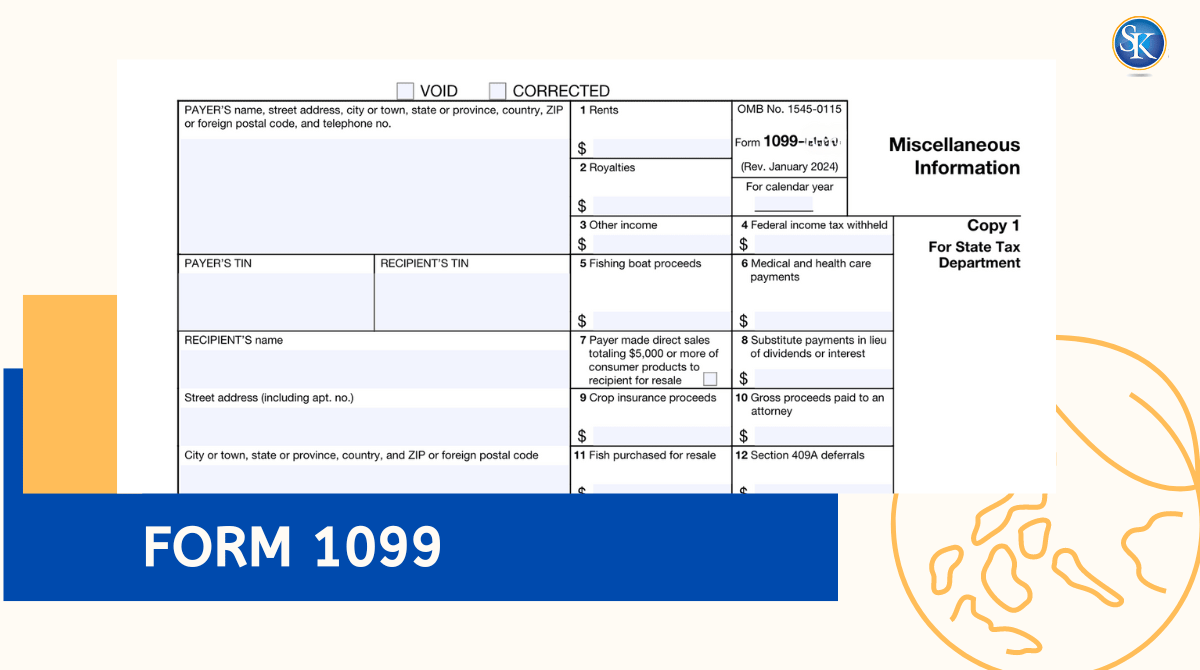

Read MoreForm 1099 : How It Works, Who Gets One

1099 form is an IRS information return used to report various types of non-wage income such as freelance earnings, dividends, interest, or rent. It ensures all income sources are properly reported and taxed.

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us