What is Form 8949? How to Fill Out Form 8949

Form 8949 is what you need to tell the IRS about any stocks, cryptocurrencies, real estate, or other investments you sold during the year. The form tells you what you bought, when you sold it, how much you paid for it, and how much you got for it. It separates short-term and long-term gains so that the right tax rate is used. It also works with Schedule D to find out how much money you made or lost in capital gains. Filling out Form 8949 correctly helps you stay accurate, makes sure the IRS doesn't mix up your 1099-B forms, and makes sure your losses lower your taxable income when they can.

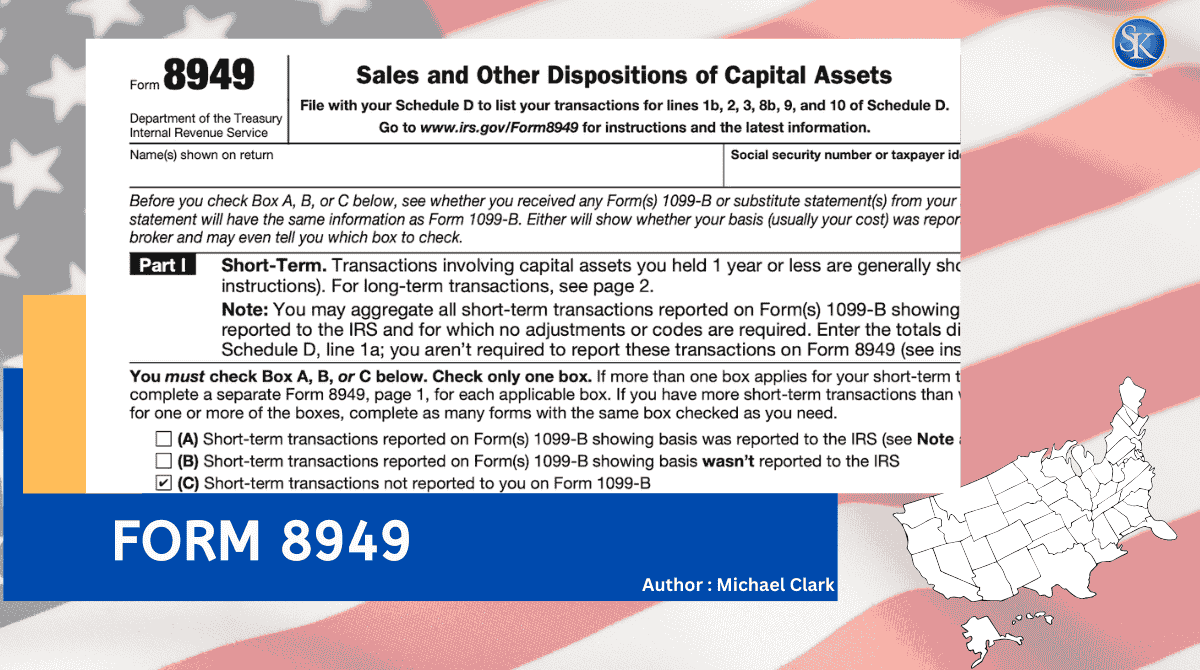

What is Form 8949?

You can use Form 8949 to check that the information your broker or agent has already sent to the IRS on forms like 1099 B or 1099 S matches the information you put on your own tax return. The numbers from Form 8949 are moved to Schedule D after you finish the subtotals. After that, Schedule D adds everything up to figure out how much money you made or lost that year.

Why Do You Need Form 8949?

Form 8949 is important because it tells the IRS everything it needs to know about your investments. You make money when you sell something for more than you paid for it. You lose money if you sell it for less. Both are important during tax time because gains can make you owe more money, and losses can make you owe less. This form makes sure that the information you give your broker on the 1099-B matches what you have on file. This keeps your filing clear and helps you avoid problems later.

Who Has to File this Form 8949?

Many people need to file Form 8949 each year and it is not just for individuals. Partnerships, corporations, estates, and trusts also use it when they sell capital assets. You will most likely need this form if you

-

Sold investments like stocks, bonds, mutual funds, cryptocurrency, or real estate

-

Had a non business bad debt that you could not recover or owned a security that became worthless

-

Chose to defer a gain by investing in a Qualified Opportunity Fund

Short Term vs Long Term Gains

Form 8949 is used to report capital asset sales and dispositions to the IRS, and it works in conjunction with Schedule D. The form is divided into two main parts to distinguish between short-term and long-term transactions, as they are taxed differently.

|

Feature |

Short-Term Capital Gains |

Long-Term Capital Gains |

|

Holding Period |

One year or less. The holding period begins the day after you acquire the asset and ends on the day you sell it. |

More than one year. The holding period is the same as for short-term gains, just longer. |

|

Form 8949 Section |

Part I. |

Part II. |

|

Tax Rate |

Taxed at your ordinary income tax rates, which can be as high as 37% (as of the 2024 tax year). 💸 |

Taxed at preferential, lower rates of 0%, 15%, or 20%, depending on your taxable income and filing status. 💰 |

|

Purpose on Form 8949 |

To report gains or losses from the sale or exchange of assets held for one year or less. The net result from this section is then carried over to Schedule D. |

To report gains or losses from the sale or exchange of assets held for more than one year. The net result from this section is also carried over to Schedule D. |

|

Box to Check |

You must check one of three boxes (A, B, or C) in Part I to indicate whether the basis was reported to the IRS on Form 1099-B. |

You must check one of three boxes (D, E, or F) in Part II to indicate whether the basis was reported to the IRS on Form 1099-B. |

Step by Step How to Fill Out Form 8949

When you first look at Form 8949 it may seem like a long table, but filling it out is easier when you take it step by step. Each line is simply the story of one transaction.

-

Write a short description of what you sold, such as 100 shares of a company or a piece of cryptocurrency.

-

Add the date you bought the investment and the date you sold it.

-

Enter the amount you received from the sale.

-

Enter the amount you originally paid, including fees or commissions.

-

Note any adjustments that apply, such as a wash sale correction.

-

Calculate the final gain or loss for that transaction.

-

Add up all the lines at the bottom of the form. The totals then move to Schedule D, which shows the complete summary of your gains and losses for the year.

How Form 8949 and Schedule D Work Together

Form 8949 and Schedule D are designed to work side by side. Form 8949 holds the details of each sale so the IRS can see what you bought, when you sold it, and the result of that transaction. Schedule D then brings all those details together and shows the overall gain or loss for the year. If you only had Schedule D the IRS would see totals but not the breakdown. If you only had Form 8949 your return would be filled with too much detail. By using both, your tax filing stays clear and complete.

Is Form 8949 Required for Reporting Cryptocurrency Transactions?

You have to report cryptocurrency trades and sales on Form 8949. You may have to pay taxes on any of the following: selling coins, trading one coin for another, or using crypto to buy something. It's important to keep track of your own dates and amounts because many exchanges don't keep full records. Keeping things in order helps you report correctly, and this is important because the IRS is keeping a close eye on crypto activity.

Read more about form 1120

Expert Help with Form 8949

Filing Form 8949 can be easy when there are only a few trades, but it becomes challenging quickly with many trades or special rules. When you work with a CPA firm that has been around for a while, you can be sure that everything will be done right. With care and accuracy, our team has helped thousands of clients file their taxes and report their investments. Book a free consultation today if you want professional help with your return.

Conclusion

Form 8949 is the IRS form you use to report gains and losses from selling investments. Along with Schedule D, it gives you a complete picture of your yearly results. Each entry tells you what you sold, when you bought it, how much you paid, and what you got. Most of the time, the information for stock trades comes from the 1099 B form that brokers send out every year. This makes the process easier to handle.

FAQs

Can I file my taxes without Form 8949 if my broker sent me a summary?

You may be able to attach the broker statement instead of listing every trade, but you still need to include totals and make sure the numbers match.

What happens if I make a mistake on Form 8949?

If you realize you entered something wrong, you can correct it by filing an amended return. Keeping clear records helps reduce the chance of mistakes in the first place.

Do real estate sales always go on Form 8949?

Most real estate sales are reported on this form, but if you sold your primary home and meet the IRS rules for exclusion, you may not need to report that gain.

Can losses on Form 8949 lower my regular income tax?

Yes, if your losses are greater than your gains, you can use up to three thousand dollars of those losses to reduce your taxable income each year, and any extra losses can carry forward.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.