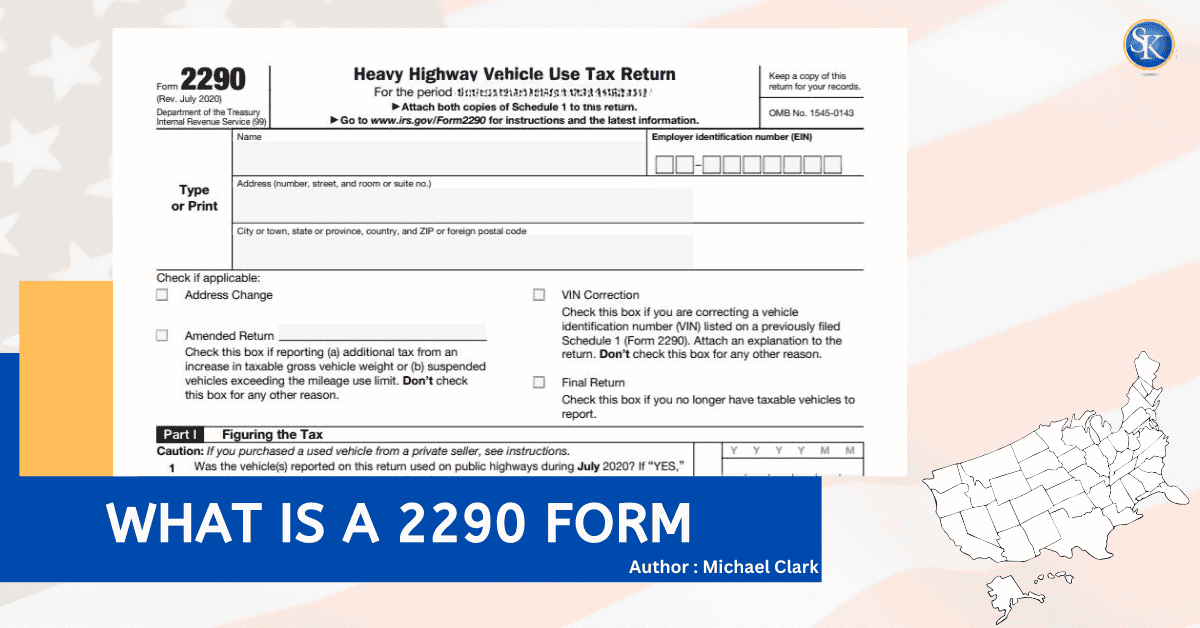

What is Form 2290? Why do you need to file a Form 2290?

If you operate a heavy truck in the United States, Form 2290 is a required annual filing with the Internal Revenue Service.

If your vehicle weighs 55,000 pounds or more and operates on public highways, you are required to file Form 2290 and pay the Heavy Highway Vehicle Use Tax (HVUT). Filing it correctly keeps your truck legally registered and avoids costly IRS penalties.

What Is Form 2290?

Form 2290 is used to calculate and pay the Heavy Highway Vehicle Use Tax. This tax applies to large highway vehicles because heavier trucks create more wear and tear on public roads.

Unlike income tax, HVUT is not based on how much money you make. It is based entirely on the vehicle’s taxable gross weight and whether it is used on public highways.

For the current IRS tax period (July 2025 – June 2026), the maximum annual HVUT is $550 per vehicle for trucks weighing 75,000 pounds or more. Even if your business had a slow year, the obligation still applies if the vehicle was used.

Read more : Best CPA Services In Tampa, Florida, US

Why Do You Need to File Form 2290?

Many truck owners only realize the importance of Form 2290 when the DMV asks for proof.

The IRS requires this filing because HVUT revenue supports highway construction and maintenance. But for you, the real impact is operational.

Without filing:

-

You cannot renew vehicle registration

-

You cannot obtain valid tags

-

You cannot legally operate the vehicle

In simple terms, no Form 2290 means your truck cannot stay on the road.

For fleet managers, this becomes even more critical because one missed filing can delay multiple vehicle registrations.

Who Must File Form 2290?

You must file if:

-

The vehicle’s gross weight is 55,000 pounds or more

-

It is registered in your name

-

It was first used on public highways during the tax period

This applies to owner-operators, LLCs, corporations, partnerships, and even nonprofit organizations operating qualifying vehicles.

The key factor is not business size. It’s ownership and usage.

If the truck is registered under your EIN or SSN, the responsibility falls on you.

You can Ask Questions here directly about CPA & CFP

Understanding the Form 2290 Tax Year

Form 2290 does not follow the standard January-to-December tax year. The HVUT tax period runs from July 1 to June 30. That means if your truck was first used in July 2025, the filing deadline is August 31, 2025.

If you first used the truck in October, your deadline would be November 30. This rolling deadline system catches many first-time filers off guard.

Form 2290 Filing Deadlines (2025–2026 Cycle)

|

First Used Month |

Filing Deadline |

|

July |

August 31 |

|

August |

September 30 |

|

September |

October 31 |

|

October |

November 30 |

|

November |

December 31 |

|

December |

January 31 |

|

January |

February 28 |

|

February |

March 31 |

|

March |

April 30 |

|

April |

May 31 |

|

May |

June 30 |

|

June |

July 31 |

Filing early is always safer than filing on the last day, especially during peak season in August.

How Much Does Form 2290 Cost?

The tax starts at $100 for vehicles weighing 55,000 pounds. It increases by $22 for every 1,000 pounds over that threshold until it reaches the maximum of $550.

For example:

-

A 60,000-pound truck will owe more than $100

-

A truck at or above 75,000 pounds will pay the full $550

Special Situations

Logging vehicles qualify for reduced tax rates under IRS classification. If a vehicle travels 5,000 miles or less annually (7,500 miles for agricultural vehicles), it qualifies as a suspended vehicle. You still must file Form 2290, but you will not owe the tax. This is one of the most misunderstood rules. Suspension does not eliminate filing requirements.

E-Filing Requirement

Under current IRS rules, if you are reporting 10 or more vehicles, you are required to e-file. Even if filing for one vehicle, e-filing is faster and more reliable.

Most truckers choose e-file because:

-

You receive your stamped Schedule 1 quickly

-

There is less chance of processing delay

-

You avoid mailing time

During August peak filing season, paper filings can slow down significantly.

What Is Schedule 1?

Schedule 1 is proof that you filed Form 2290 and paid HVUT. After processing, the IRS stamps Schedule 1 and returns it to you. The DMV requires this document before issuing or renewing registration. It is one of the most important documents in commercial vehicle compliance. Keep a digital and physical copy.

What Happens If You Don’t File?

The IRS imposes penalties quickly:

-

4.5% of total tax due per month (up to five months)

-

Additional interest accrues monthly

-

Registration renewal may be blocked

For fleet operators, noncompliance can disrupt multiple trucks at once. It is far more expensive to delay than to file on time.

What If You Sell or Retire a Truck?

If a vehicle is sold, destroyed, or permanently taken off the road during the tax period, you may qualify for a partial HVUT refund.

You must file an amended Form 2290 and document the date the vehicle was removed from service. This is often overlooked, and many owners leave refund money unclaimed.

Common Filing Mistakes

The most frequent issues include:

-

Entering incorrect VIN numbers

-

Missing the August 31 deadline

-

Forgetting to file suspended vehicles

-

Waiting too long to paper file

-

Losing stamped Schedule 1

One incorrect VIN digit can delay registration. Always verify carefully before submission.

Why Many Truck Owners Prefer Professional Help

While Form 2290 is not overly complex, compliance mistakes are costly. For owner-operators managing routes, maintenance, and fuel costs, it’s easy to overlook a deadline or enter incorrect data.

Professional filing ensures:

-

Accurate VIN entry

-

Correct tax calculation

-

On-time submission

-

Immediate access to Schedule 1

Conclusion

Form 2290 is required for heavy highway vehicles weighing 55,000 pounds or more. It supports highway infrastructure and ensures commercial vehicles operate legally.

Understanding deadlines, tax rates, and Schedule 1 requirements helps you avoid penalties and keep your truck moving without interruption. Filing properly is not just about compliance. It protects your ability to operate.

FAQs

I only have one truck. Do I still need to file Form 2290?

Yes. It doesn’t matter whether you own one truck or fifty. If it weighs 55,000 pounds or more and runs on public highways, you’re required to file.

What if I just bought my truck in the middle of the year?

You don’t wait until next July. You file based on the month the truck was first used on public highways. The deadline is the last day of the following month.

My truck didn’t run much this year. Can I skip filing?

No. Even if it qualifies as a low-mileage or suspended vehicle, you still have to file Form 2290. You just won’t owe the tax.

How fast do I actually get Schedule 1 after filing?

If you e-file and pay successfully, you usually receive your stamped Schedule 1 within minutes. Paper filing can take several weeks.

What happens if I enter the wrong VIN by mistake?

The IRS won’t accept it as valid proof. You’ll need to file a VIN correction before the DMV accepts your Schedule 1.

Is Form 2290 something my accountant handles, or should I?

Many owner-operators file it themselves through an approved e-file provider. But if you manage multiple vehicles or want to avoid compliance errors, professional help can save time and stress.

Do I have to pay the full $550 for every heavy truck?

Only vehicles at or above 75,000 pounds pay the full amount. Lighter qualifying vehicles pay less, starting at $100.

If I sell my truck, can I get some of the tax back?

Yes, possibly. If the vehicle was sold or taken off the road during the tax year, you may qualify for a partial refund by filing an amended return.

Does Form 2290 affect my income tax return?

No. HVUT is separate from income tax. It’s based on vehicle weight and road use, not business profits.

What’s the biggest mistake truck owners make with Form 2290?

Waiting until registration renewal to think about it. By then, deadlines may have already passed, and penalties may be building.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.