Form 1098: Statement of Mortgage Interest and How to File It

Form 1098 is a family of IRS forms that report payments you made during the year that may qualify for tax deductions or credits like mortgage interest, student loan interest, tuition, and some vehicle donations. If you receive any type of Form 1098, it usually means you paid something that could reduce your tax bill or increase your refund.

What Is Form 1098?

Form 1098 isn’t just one form. It’s a group of forms the IRS uses so banks, loan servicers, schools, and charities can report certain payments you made during the year.

Those payments might help you:

-

Claim a mortgage interest deduction

-

Claim a student loan interest deduction

-

Claim education tax credits

-

Claim a charitable contribution deduction for certain donated vehicles

You don’t fill out Form 1098 yourself. Instead, you receive it and use the information when you file your tax return.

Types of Form 1098 and What They Report

There are four main versions of Form 1098:

-

Form 1098 – Mortgage Interest Statement

-

Form 1098-E – Student Loan Interest Statement

-

Form 1098-T – Tuition Statement

-

Form 1098-C – Contributions of Motor Vehicles, Boats, and Airplanes

Let’s look at each one and how it can help you at tax time.

Best and affordable CPA services in Tampa, FL, US

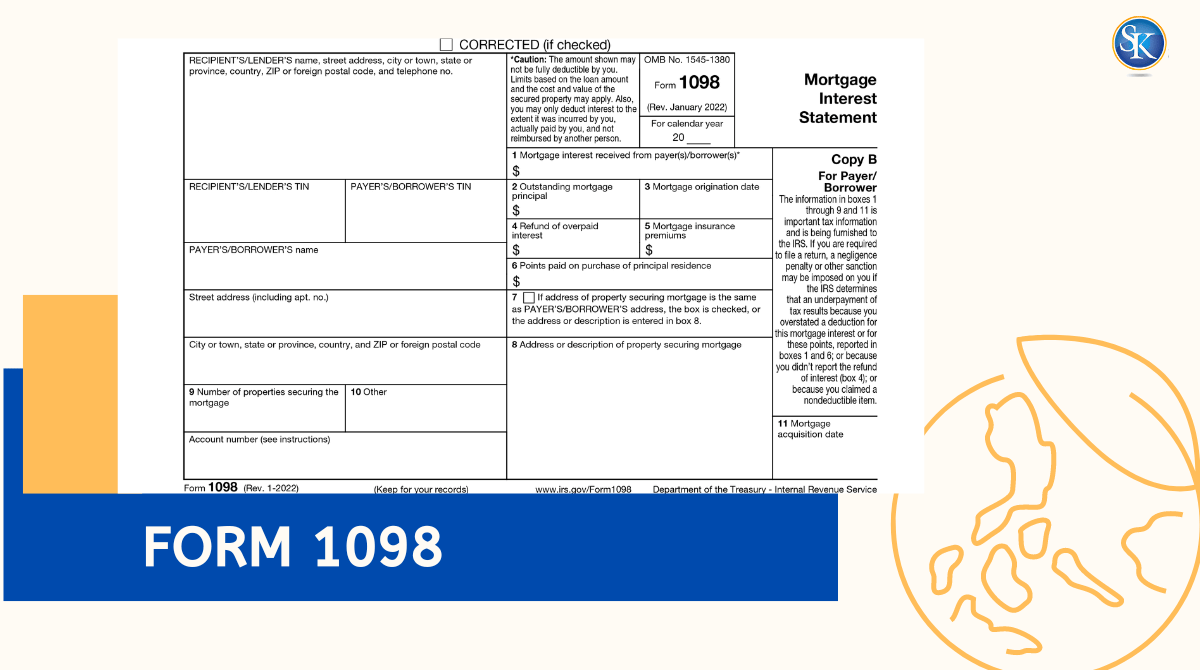

Form 1098: Mortgage Interest Statement

If you own a home and paid $600 or more in mortgage interest during the year, your lender usually sends you Form 1098.

What Form 1098 (Mortgage) Shows

Form 1098 typically includes:

-

Total mortgage interest you paid during the year

-

Points you paid to lower your interest rate (sometimes deductible)

-

Refunded interest, if you overpaid interest and received some back

-

The address of the property securing the mortgage

-

The lender’s and borrower’s information

How the Mortgage Interest Deduction Works

Mortgage interest may be deductible if:

-

The loan was used to buy, build, or substantially improve your primary home or a qualified second home.

-

You itemize deductions instead of taking the standard deduction.

If you have a large mortgage or live in a high-cost area, mortgage interest can be one of your biggest itemized deductions, potentially lowering your taxable income by thousands of dollars.

Example: If you paid $9,000 in mortgage interest and you itemize, that $9,000 can reduce the income you’re taxed on, which may lower your overall tax bill.

Form 1098-E: Student Loan Interest Statement

If you paid $600 or more in interest on a qualified student loan, your loan servicer usually sends you Form 1098-E.

What Form 1098-E Reports

It shows:

-

The total student loan interest you paid during the year

-

The loan servicer’s information

-

Your details as the borrower

Using Form 1098-E for the Student Loan Interest Deduction

You may be able to deduct up to $2,500 of qualified student loan interest you paid during the year, even if you don’t itemize deductions.

However, you must:

-

Have taken the loan solely for qualified education expenses (tuition, fees, room and board, etc.)

-

Be legally obligated to pay the loan

-

Meet income limits if your modified adjusted gross income (MAGI) is too high, the deduction is reduced or phased out.

Form 1098-T: Tuition Statement

If you or your dependent attended an eligible college or university, you might receive Form 1098-T from the school.

What Form 1098-T Includes

The form usually shows:

-

Qualified tuition and related expenses required for enrollment

-

Adjustments to amounts reported for prior years

-

Scholarships or grants applied to your tuition

How Form 1098-T Helps With Education Credits

You use Form 1098-T to check if you qualify for:

-

American Opportunity Tax Credit (AOTC) up to $2,500 per eligible student for the first four years of higher education

-

Lifetime Learning Credit (LLC) up to $2,000 per tax return for qualifying education at any level

The amounts on the form give you a starting point, but they don’t always equal your final credit. You may need to:

-

Add other qualified expenses (like required books)

-

Subtract scholarships or grants that reduce those expenses

Form 1098-C: Vehicle, Boat, and Airplane Donations

If you donated a car, boat, airplane, or similar vehicle to a qualified charity, you may receive Form 1098-C.

Key Details on Form 1098-C

The form typically shows:

-

Information about the vehicle (make, model, VIN)

-

The date you donated it

-

What the charity did with it:

-

Gross proceeds from the sale, if they sold it, or

-

A statement that they kept and used it for charitable work

-

How It Affects Your Deduction

Your deduction usually depends on how the charity uses the vehicle:

-

If the charity sells the vehicle, your deduction is typically limited to the sales price.

If the charity uses the vehicle in its operations or gives it to someone in need, you may be able to deduct the fair market value.

How To Use Form 1098 When Filing Your Taxes

Here’s a simple way to handle Form 1098 information at tax time:

1. Collect all 1098s you receive

- 1098 from your mortgage lender

- 1098-E from student loan servicers

- 1098-T from schools

- 1098-C from charities

2. Match the amounts with your own records

- Compare with mortgage statements, loan statements, tuition bills, or donation receipts.

3. Decide how each form affects your return

- Form 1098 → possible mortgage interest deduction (itemized)

- Form 1098-E → student loan interest deduction (above-the-line)

- Form 1098-T → education credits (AOTC or LLC)

- Form 1098-C → charitable contribution deduction

4. Enter the amounts in your tax software or give them to your tax professional

5. Keep all Forms 1098 and backup records

- Keep them for at least three years, in case the IRS asks for proof.

Why Should You Pay Attention to Form 1098?

Form 1098 is much more than just another document in your tax file. It represents an opportunity to optimize your tax deductions. By properly utilizing the information reported on this form, you can significantly reduce your taxable income, leading to a smaller tax obligation. This could mean more money in your pocket or even a bigger refund. Understanding the different types of Form 1098, and knowing how to correctly apply the information they provide, is crucial for smart tax planning. So, let’s explore each type in detail to ensure you’re making the most of these potential tax benefits.

Common Mistakes to Avoid With Form 1098

1. Not Itemizing When It Would Save More

-

If you pay high mortgage interest, state taxes, or medical expenses, itemizing could give you a larger deduction than the standard deduction.

-

Always compare your itemized deductions vs. standard deduction before deciding.

2. Ignoring Eligibility Rules

-

Not every payment reported on a 1098 automatically means you qualify for a deduction or credit.

Check:

- Income limits for student loan interest and education credits

- Whether expenses are truly qualified education costs

- How scholarships and grants affect your 1098-T amounts

3. Misreporting or Relying Only on the Form

-

Sometimes Form 1098 doesn’t show every eligible expense (for example, some course materials).

Always:

- Cross-check the form with your own invoices and receipts

- Make sure the numbers you enter on your return match or properly adjust the reported amounts

Taking a few extra minutes to verify can prevent IRS notices and help you get the full tax benefit you’re entitled to.

Conclusion

Form 1098 might look like just another tax document, but it can play a huge role in reducing your tax bill. Each version of Form 1098 gives you information that can turn into valuable deductions or credits if used correctly. Keep your forms, check them against your records, and make sure you’re not leaving money on the table when you file your return.

FAQ’s

Why didn’t I get a Form 1098?

You may have paid less than $600 in interest or the lender didn’t issue it yet.

Can I claim deductions without Form 1098?

Yes use statements or receipts as proof.

Do I get multiple 1098s if I refinanced?

Yes, you can receive one from each lender.

Does Form 1098 increase my refund?

It can, if the information leads to a deduction or credit.

Is Form 1098 required for e-filing?

No. Just enter the amounts; keep the form for records.

Do landlords receive Form 1098?

Only if the landlord pays mortgage interest on the rental property.

Can I get Form 1098-T if I’m part-time?

Yes, if you paid qualified tuition.

Is student loan interest deductible if someone else paid it?

No. Only the person legally obligated on the loan can deduct it.

Does 1098-C mean I can deduct the full value of my car?

Not always your deduction depends on how the charity used or sold it.

Do scholarships reduce my 1098-T credit?

Yes scholarships lower the expenses you can claim.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.