Form 1099-NEC: What things you need to know about the Form 1099-NEC

Form 1099-NEC is an IRS form businesses must send when they pay a non-employee like a freelancer or contractor $600 or more for services in a tax year. Its purpose is to provide clarity and streamline the reporting process, ensuring that payments made to independent contractors, freelancers, and other nonemployees are accurately documented and reported. In this blog we'll discuss details of Form 1099-NEC, explaining who needs to file it, what information it requires, and the tax implications for recipients.

Read more about Form 8949

What is a Form 1099 NEC?

Form 1099-NEC or Nonemployee Compensation, is used by businesses to report payments made to individuals who are not employees. This includes independent contractors, freelancers, sole proprietors, and other self-employed individuals who provide services to the business. Before 2020, this income was reported on Form 1099-MISC (Box 7), but the IRS brought back 1099-NEC to simplify deadlines and reduce filing errors.

What things you need to know about form 8938

Who Must File Form 1099-NEC and When

-

You paid someone who is not your employee

-

The payment was for business services, not personal work

-

The total paid was $600 or more during the year

-

You must file by January 31 and send a copy to the recipient

Example: You hire a freelance designer and pay $1,000 for a project. You must issue Form 1099-NEC to that designer and file a copy with the IRS.

Key Information About Form 1099-NEC

|

Criteria |

Description |

|

Purpose |

Reports nonemployee compensation to the IRS. |

|

Who Receives It |

Independent contractors, freelancers, sole proprietors, self-employed individuals. |

|

Reporting Threshold |

Payments totaling $600 or more per year. |

|

Due Date to Recipients |

January 31. |

|

Due Date to IRS |

January 31. |

|

Replaces |

Nonemployee compensation was previously reported on Form 1099-MISC. |

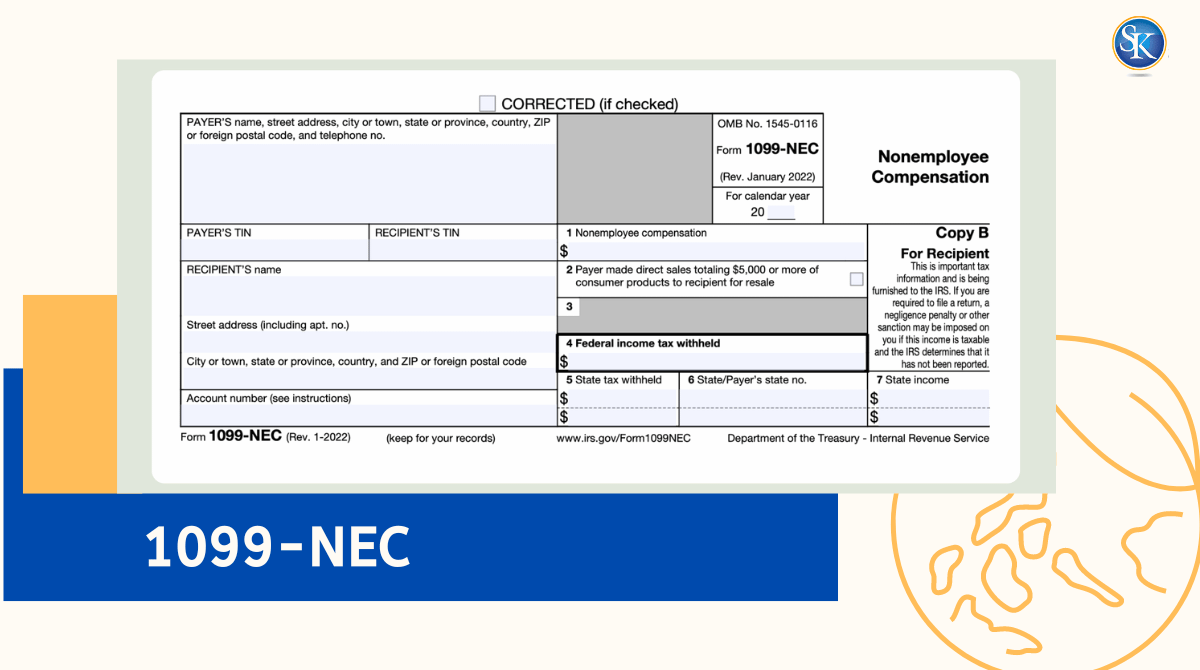

What Information You Need to Complete Form 1099-NEC

The IRS requires these key details when completing the form:

-

name

-

address

-

TIN

-

amount paid

-

tax withheld (Box 4)

Check here: Top accounting and bookkeeping services in FL,US

Nonemployee Compensation

Nonemployee compensation is a broad category that encompasses a variety of payments made to individuals who provide services to a business without being employed by it. This form of compensation is crucial in today's economy, where gig work, freelance projects, and independent consulting play significant roles.

Fees for Professional Services

This includes payments to professionals such as attorneys, accountants, contractors, and other specialists who offer their expertise on a non-employee basis. These professionals often work independently, providing valuable services that are essential to a business's operation and success.

Commissions

Payments made to independent sales representatives also fall under nonemployee compensation. These commissions are typically based on sales performance and can constitute a significant portion of an independent contractor's income.

Referral Fees

In some industries, professionals may pay each other for client referrals. These referral fees are considered nonemployee compensation and must be reported accordingly. This practice is common in fields such as real estate, legal services, and consulting, where professionals often collaborate and share clients.

Service Fees

Payments for services that include parts or materials used to perform the services are also included in this category. For example, a contractor might provide labor and supplies materials necessary for the job. It's essential to report the total amount paid, including both labor and materials, to ensure full compliance with IRS requirements.

Prizes and Awards

Occasionally, businesses might award non-employees for services performed, which can take the form of prizes or monetary awards. These payments, while sometimes less frequent, still constitute nonemployee compensation and must be reported on Form 1099-NEC. This ensures that the IRS is aware of all forms of income received by independent contractors and other non-employees.

Backup Withholding and W-9 Forms

Always request a Form W-9 from each contractor before paying them. If a payee refuses to provide a Taxpayer ID Number, you must withhold 24 percent of the payment (called backup withholding) and report it in Box 4 of Form 1099-NEC.

Tax Impact for Contractors

Income on a 1099-NEC is subject to self-employment tax 12.4% Social Security plus 2.9% Medicare. Contractors also pay an extra 0.9 percent Medicare tax if earnings exceed $200,000 (single) or $250,000 (joint).

1099-NEC vs. 1099-MISC

Before the reintroduction of Form 1099-NEC, nonemployee compensation was reported in Box 7 of Form 1099-MISC. The redesign of the 1099-MISC form removed this box, and nonemployee compensation is now exclusively reported on Form 1099-NEC. This change helps to clarify reporting requirements and deadlines, reducing confusion for businesses and recipients.

Differences Between 1099-NEC and 1099-MISC

The IRS uses Forms 1099-NEC and 1099-MISC to capture different types of payments made by businesses to non-employees and other entities. Understanding the distinctions between these forms is crucial for accurate reporting and compliance. Below is a detailed comparison of the two forms:

|

Feature |

Form 1099-NEC |

Form 1099-MISC |

|

Purpose |

Reporting nonemployee compensation |

Reporting miscellaneous income |

|

Types of Payments Reported |

Fees for professional services, commissions, prizes, and awards for non-employees |

Rent, royalties, prizes, awards, healthcare payments, attorney fees, and other miscellaneous payments |

|

Key Box Used |

Box 1: Nonemployee Compensation |

Box 1: Rents, Box 2: Royalties, Box 3: Other Income, etc. |

Filing and Receiving Form 1099-NEC

Businesses must file Form 1099-NEC with the IRS and provide a copy to the recipient by January 31 each year. The form can be filed electronically or on paper, depending on the preference and capabilities of the business. Recipients of Form 1099-NEC should use the information provided to report their income on their tax returns accurately.

Steps to File Form 1099-NEC

Filing Form 1099-NEC correctly and on time is crucial for businesses that pay non-employees for their services.

Here is a step-by-step guide to ensure you meet the requirements and avoid potential penalties.

1. Gather Information

Before you can fill out Form 1099-NEC, you need to collect specific details about each recipient. This step is foundational and requires diligence to ensure accuracy.

-

Recipient's Name: Obtain the full legal name of the individual or entity receiving the payment. This information is typically collected through a W-9 form, which you should request from your non-employee service providers.

-

Recipient's Address: Ensure you have the recipient's current mailing address. This is essential for sending them a copy of the form.

-

Taxpayer Identification Number (TIN): The recipient's TIN can be a Social Security Number (SSN), Employer Identification Number (EIN), or another type of TIN. This information should also be gathered from the W-9 form.

-

Payment Amount: Document the total amount paid to the recipient over the year.Only payments totaling $600 or more need to be reported.

Accurate and thorough collection of this information helps prevent errors that could lead to delays or penalties.

2. Complete the Form

With all the necessary information in hand, you can proceed to fill out Form 1099-NEC. This step requires attention to detail to ensure the form is completed correctly.

-

Box 1 - Nonemployee Compensation: Enter the total amount paid to the recipient for the year. This figure represents all payments for services rendered by the non-employee.

-

Box 4 - Federal Income Tax Withheld: If any federal income tax was withheld from the payments, report that amount here. While not common, it’s important to include this information if applicable.

-

Recipient's Information: Fill in the recipient’s name, address, and TIN in the appropriate sections of the form.

-

Payer's Information: Enter your business’s name, address, and TIN. This information identifies you as the IRS payer.

Double-check all entries for accuracy to ensure there are no mistakes that could cause issues with the IRS or the recipient.

3. Send Copy to Recipient

After completing the form, you need to provide a copy to the recipient. This step must be done promptly to allow the recipient time to prepare their tax returns.

-

Deadline: Ensure the recipient receives their copy by January 31 of the following year. Timely delivery helps them accurately report their income.

-

Delivery Methods: You can send the form via mail or electronically, depending on the recipient’s preference. For electronic delivery, ensure you comply with IRS guidelines for secure transmission.

Providing the recipient with their copy on time is a critical component of the filing process.

4. File with the IRS

The final step is submitting the completed form to the IRS. This can be done either electronically or on paper, but each method has specific requirements and deadlines.

-

Deadline: The form must be filed with the IRS by January 31. Unlike some other forms, there is no extended deadline for filing Form 1099-NEC.

-

Electronic Filing: If you are filing 250 or more forms, you must file electronically using the IRS FIRE (Filing Information Returns Electronically) system. Electronic filing can streamline the process and is encouraged even for fewer forms.

-

Paper Filing: If filing by paper, ensure you use the official IRS Form 1099-NEC and mail it to the appropriate IRS address based on your location. Include Form 1096, which is the transmittal form summarizing the information returns being submitted.

Filing accurately and on time helps you avoid penalties and ensures that the IRS receives the necessary information to match payments with recipients’ tax returns.

Example Scenario

To illustrate the process, consider the following scenario: You are a freelance graphic designer who completed a project for a marketing firm. The firm paid you $1,200 for your services. In this case, they are required to issue you a Form 1099-NEC by January 31 of the following year. You will receive Copy B of the form, while the firm will send Copy A to the IRS. You must report the $1,200 as income on your tax return and may need to pay self-employment taxes on that amount.

Common Mistakes to Avoid

-

Sending 1099-MISC instead of 1099-NEC for service payments

-

Forgetting to collect a W-9 from contractors

-

Missing the January 31 deadline

-

Reporting incorrect taxpayer IDs or totals

-

Issuing a form for personal, non-business payments

Conclusion

Form 1099-NEC is simple once you know the basics. It helps the IRS track income paid to independent contractors and ensures businesses report payments accurately. Keep records, collect W-9s early, and file by January 31 to stay penalty-free.

FAQs

1. Who receives Form 1099-NEC?

Anyone paid $600 or more for services as a non-employee.

2. When is the filing deadline?

Both the contractor and the IRS must receive it by January 31.

3. Do I need to send one to corporations?

Usually no, except for attorneys or law firms.

4. Can I file Form 1099-NEC online?

Yes. You can e-file through IRS-approved software.

5. What happens if I file late?

The IRS may charge a penalty ranging from $60 to $310 per form, depending on how late it is.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.