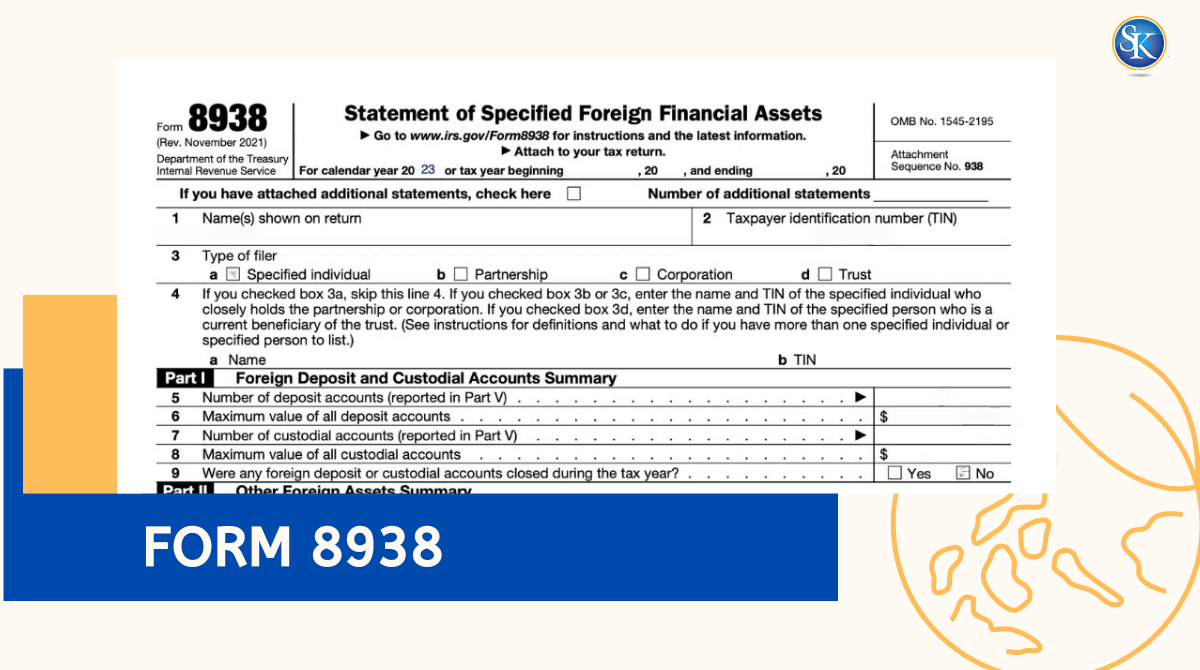

IRS Form 8938: Who Needs to File It?

IRS Form 8938, also known as the Statement of Specified Foreign Financial Assets, is used by U.S. taxpayers to report their foreign financial assets to the IRS. If your total foreign assets exceed certain limits, you must file this form along with your tax return. In this guide, you’ll learn who needs to file Form 8938, how it differs from the FBAR, and what penalties apply if you don’t.

Who Must File IRS Form 8938

You must file IRS Form 8938 if you are a U.S. citizen, resident alien, or qualifying non-resident with specified foreign financial assets above the reporting threshold. The filing thresholds vary based on whether you live in the U.S. or abroad and your filing status.

|

Filing Status |

Living in the U.S. |

Living Abroad |

|

Single |

> $50,000 at year-end or > $75,000 at any time |

> $200,000 at year-end or > $300,000 at any time |

|

Married Filing Jointly |

> $100,000 at year-end or > $150,000 at any time |

> $400,000 at year-end or > $600,000 at any time |

|

Married Filing Separately |

> $50,000 at year-end or > $75,000 at any time |

> $200,000 at year-end or > $300,000 at any time |

Example: If you live in the U.S. and have $55,000 in foreign bank accounts at the end of the year, you must file Form 8938 with your tax return.

What is Form 8938?

Form 8938 is an IRS form used to report your foreign financial assets. It ensures all foreign income is declared for tax purposes. It applies to bank accounts, securities, trusts, and other assets held abroad. You must file this form along with your tax return if you meet the reporting limits.

When and How to File Form 8938

You must submit Form 8938 every year when you file your federal income tax return (Form 1040).

-

Deadline: April 15 (same as your regular tax return).

-

Extension: If you get a filing extension for your tax return, the same applies to Form 8938.

-

Where to File: Attach Form 8938 to your federal tax return and file it electronically or by mail.

How to Complete IRS Form 8938 (Step-by-Step)

Step 1: Fill in your name, SSN, and filing status.

Step 2: List all foreign bank and custodial accounts, including account numbers and maximum values.

Step 3: Add details of other foreign assets like stocks, bonds, and trusts.

Step 4: Include any related income such as interest or dividends.

Step 5: Indicate if these assets were reported elsewhere (like Form 3520 or 5471).

Step 6: Review all totals and attach Form 8938 to your tax return before submitting.

What to Report on IRS Form 8938

Form 8938 covers various foreign assets such as:

-

Foreign bank accounts

-

Stocks and bonds issued by foreign companies

-

Foreign mutual funds and hedge funds

-

Foreign pension or retirement accounts

-

Life insurance with cash value issued by foreign companies

FBAR vs IRS Form 8938: What’s the Difference?

Many taxpayers confuse Form 8938 with the FBAR (FinCEN Form 114). Both forms report foreign accounts, but they have different filing thresholds and agencies. You may need to file both depending on your asset type and value.

|

Aspect |

Form 8938 |

FBAR |

|

Filing Thresholds |

Higher thresholds based on filing status and residency |

$10,000 in aggregate across all accounts |

|

Filing Method |

With annual tax return (Form 1040) |

Electronically via FinCEN’s BSA E-Filing System |

|

Assets Reported |

Broad range of foreign financial assets |

Foreign financial accounts only |

Penalties for Not Filing Form 8938

Failing to file Form 8938 can lead to penalties starting at $10,000, and additional fines up to $50,000 for continued non-compliance. The IRS may also impose accuracy-related penalties or pursue criminal charges for intentional failure to report.

Tips to Stay Compliant

-

Keep yearly records of all foreign assets and their values.

-

File both FBAR and Form 8938 if required.

-

Use reliable exchange rates when reporting values.

-

Consult a tax professional if your assets are complex or held across multiple countries.

Conclusion

Filing IRS Form 8938 is essential for anyone with significant foreign assets. It helps you stay transparent, compliant, and penalty-free. By reporting your assets correctly each year, you protect yourself from IRS scrutiny and ensure peace of mind during tax season.

Contact Our experienced CPAs for personalized guidance. Our experts ensure your foreign assets are reported correctly to avoid IRS penalties.

FAQs

1. Who must file IRS Form 8938?

U.S. citizens, resident aliens, and certain non-residents with foreign assets above $50,000 must file Form 8938.

2. When is Form 8938 due?

It’s due with your annual tax return on April 15. If you file an extension, the same applies to Form 8938.

3. What happens if I don’t file Form 8938?

You can face a $10,000 penalty, with extra fines up to $50,000 for continued failure to file.

4. What assets are included in Form 8938?

Foreign bank accounts, stocks, bonds, mutual funds, pension accounts, and foreign-issued life insurance policies.

5. Do I need to file both FBAR and Form 8938?

Yes, if you meet both filing thresholds. FBAR covers foreign accounts, while Form 8938 covers a wider range of assets.

6. Can I file Form 8938 electronically?

Yes. It’s included in most tax preparation software or can be filed through your CPA with your Form 1040.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.