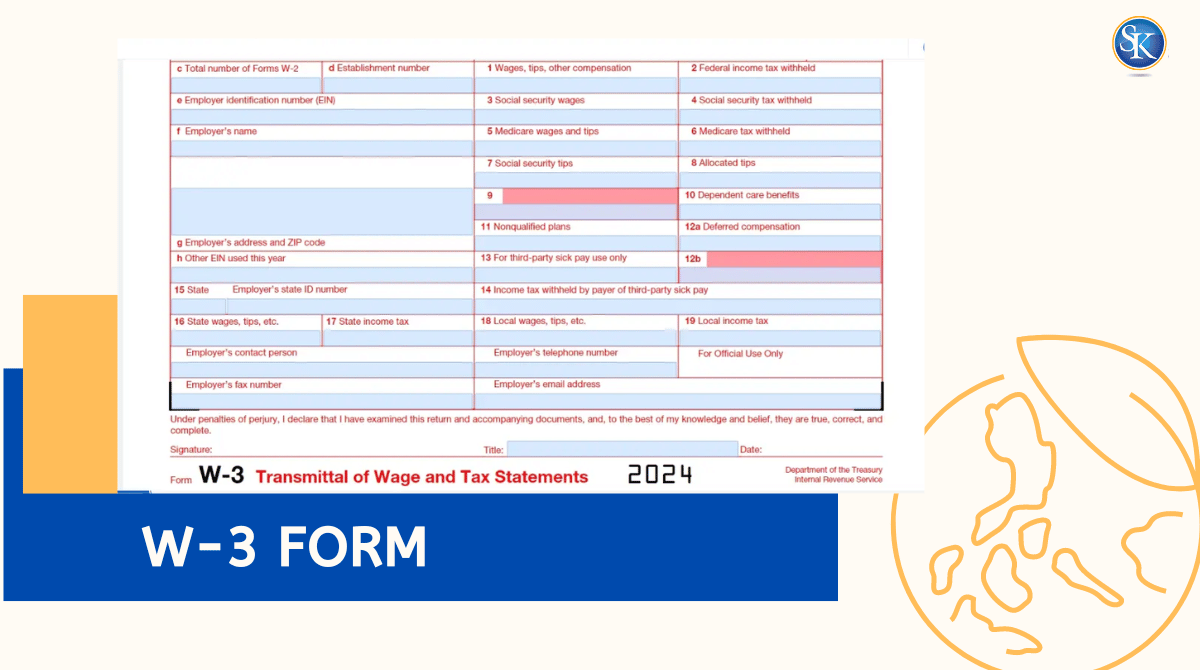

What is a W-3 Form? W-3 Form filing instructions

Form W-3 “Transmittal of Wage and Tax Statements” is a one-page form that summarizes all the W-2 information for your business.

Read MoreMarried Filing Jointly vs Separately: How Should I File?

Should I file jointly or separately? filing jointly saves you money through lower tax rates and more credits,but some couples benefit from filing separately

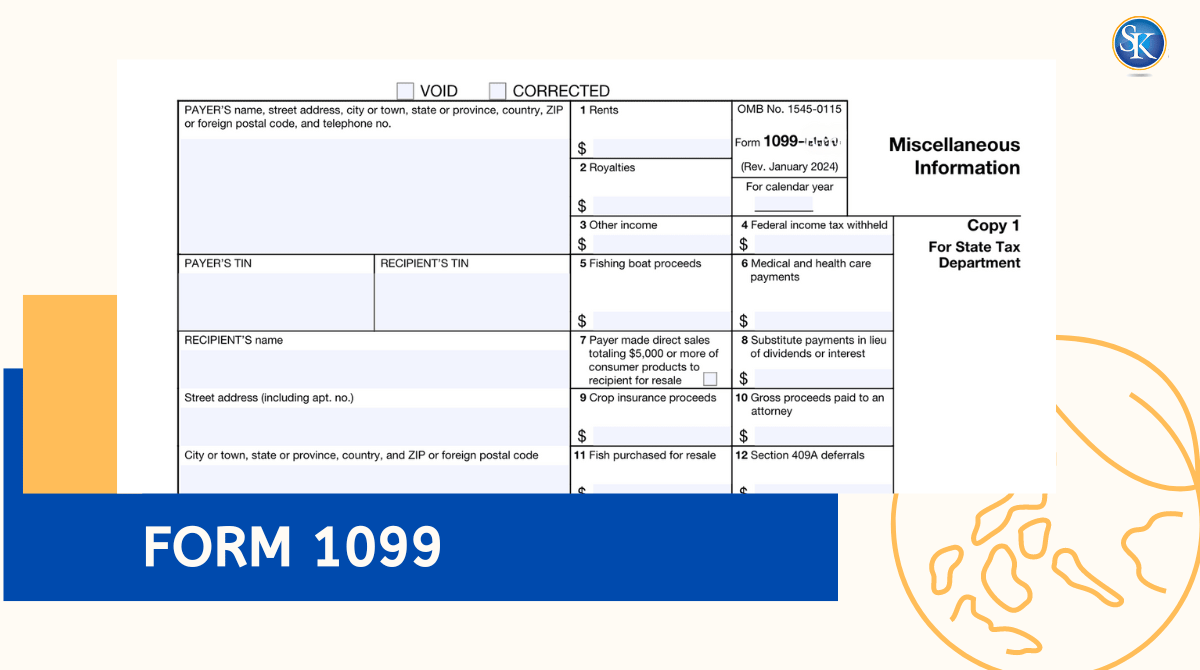

Read MoreForm 1099 : How It Works, Who Gets One

1099 form is an IRS information return used to report various types of non-wage income such as freelance earnings, dividends, interest, or rent. It ensures all income sources are properly reported and taxed.

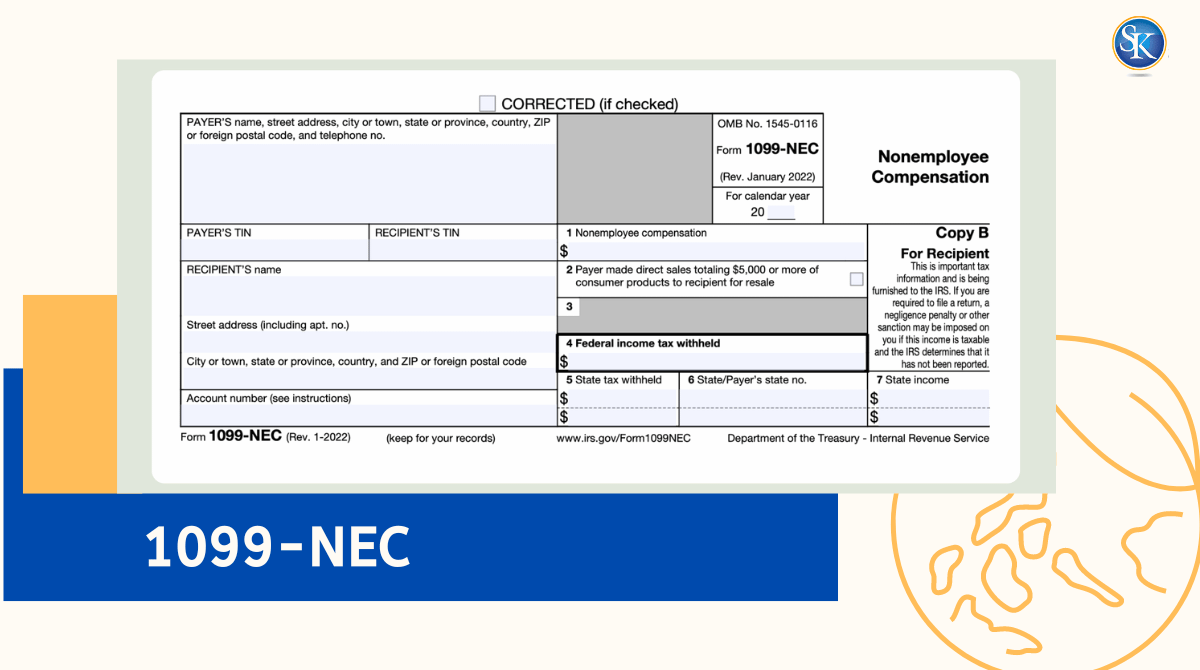

Read MoreForm 1099-NEC: What things you need to know about the Form 1099-NEC

If you have a bussiness that have totlay payment of 600$ you have to file Form 1099-NEC. Form 1099-NEC plays a crucial role for businesses and self-employed individuals

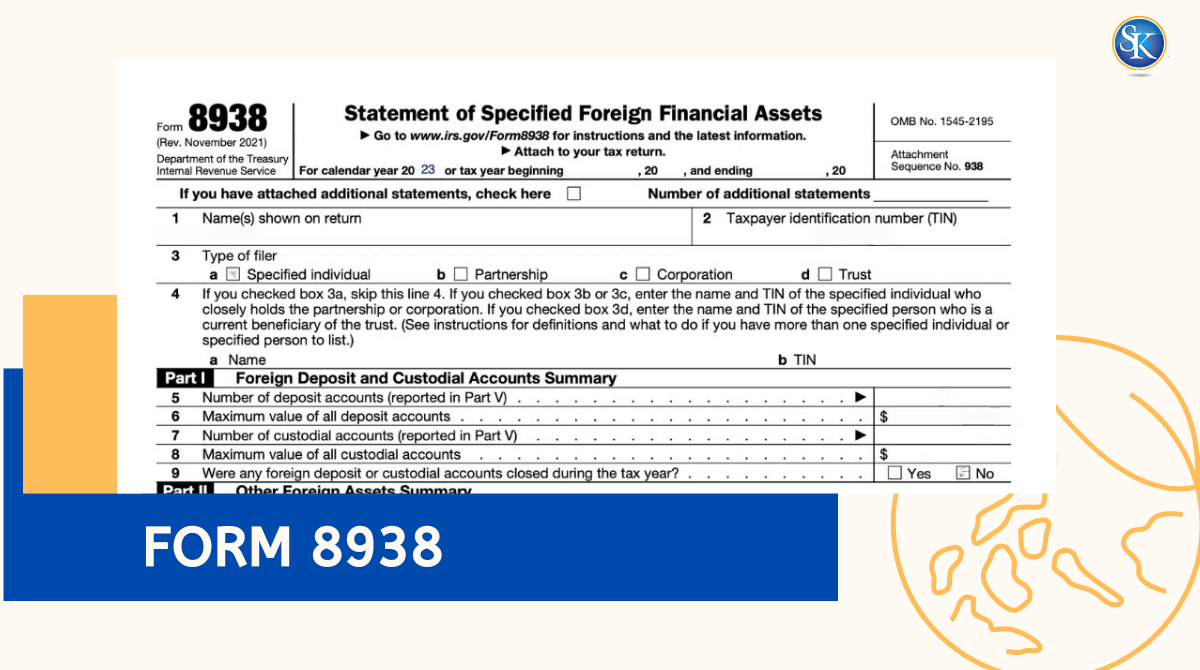

Read MoreIRS Form 8938: Who Needs to File It?

U.S. citizens, resident aliens, and certain non-resident aliens with foreign financial assets over $50K (end of year) or $75K must file IRS Form 8938.

Read MoreArizona State Income Tax: Here's everything you need to know

In Arizona, the income tax rate is 2.5%. Regardless of any other factors, taxpayers in Arizona must pay 2.5% of their previous year's income as tax.

Read MoreAlabama income tax: Here's everything you need to know

For Alabama residents, understanding the state's income tax structure is crucial for effective financial planning. Alabama's income tax rates depend on different income sources.

Read MoreFlorida Income Tax: How it Works? Step-by-Step Guideline

Florida has no individual income tax, and the state constitution protects that rule. Florida does charge a 5.5% corporate income tax and a 6% sales tax on most purchases.

Read MoreWhat the Form W-2 Box 12 Codes Mean | Instructions for Form W-2

Understand W-2 Form Box 12 codes with clear explanations, description and examples. Learn what each code means, why it matters for your taxes.

Read MoreYour Michigan Tax Refund Status: Michigan Tax Refund Information

You can check the status of your Michigan state refund online by visiting the official site. If you claim itemized deductions on your federal tax return, Michigan refunds must be reported as income.

Read MoreCategories

FREE CONSULTATION

Our dedicated team is ready to assist you with all your needs. We're here to offer you expert guidance and tailored solutions. Contact us now to discover how we can meet your requirements!

Contact Us