What is a W-3 Form? W-3 Form filing instructions

When you run payroll, one thing is guaranteed you cannot file W-2s without also filing Form W-3. It tells the Social Security Administration (SSA) the total wages, taxes withheld, Social Security wages, and Medicare wages for your entire workforce.

What Is a W-3 Form?

Form W-3 “Transmittal of Wage and Tax Statements” is a one-page form that summarizes all the W-2 information for your business. If W-2s show income for each employee, the W-3 form shows:

-

Total wages paid to ALL employees

-

Total federal income tax withheld

-

Total Social Security and Medicare wages

-

Total Social Security and Medicare tax withheld

-

Number of W-2s submitted

You cannot submit W-2s to the SSA without a W-3. They go together like a cover letter + attachments.

Best and affordable Payroll Service in FL, US

Why Employers Need Form W-3

Employers must file a W-3 because it:

-

Ensures your W-2 totals match

-

Helps the SSA update employee earnings records

-

Confirms your payroll taxes were reported correctly

-

Prevents IRS notices, mismatches, and penalties

Even if you only have one employee, you still need a W-3.

Who Must File a W-3 (and Who Doesn’t)

You MUST file Form W-3 if:

-

You issued any W-2 forms

-

You paid employees during the tax year

-

You withheld Social Security, Medicare, or federal income tax

You do NOT file Form W-3 for:

-

Independent contractors (they receive 1099-NEC)

-

Household employees not paid through payroll

-

Gig workers paid via platforms like Stripe/PayPal (they receive 1099-K)

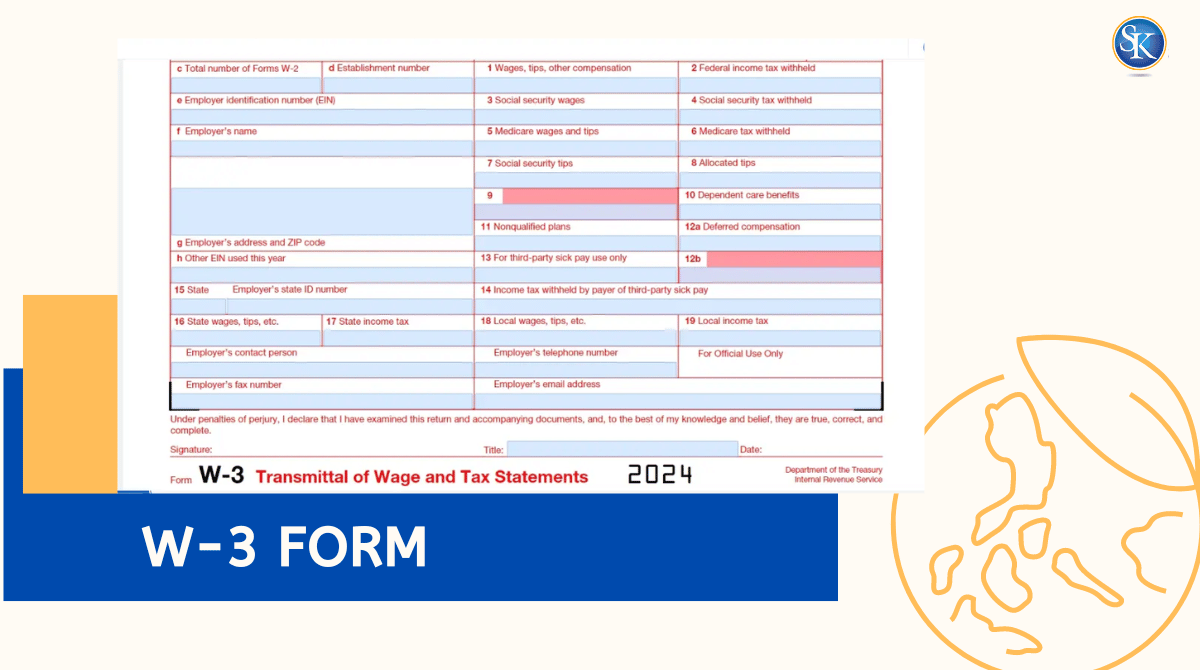

What Information Is Included in a W-3 Form?

Form W-3 summarizes the following data:

1. Total wages, tips & compensation

This includes salary, hourly pay, bonuses, commissions, and tips.

2. Total federal income tax withheld

Matches Box 2 totals from all employee W-2s.

3. Social Security wages & tips

Wages subject to the 6.2% Social Security tax.

4. Medicare wages & tips

Wages subject to Medicare tax (1.45%).

5. Social Security & Medicare taxes withheld

Critical for verifying correct payroll tax deposits.

6. Employer information (EIN, name, address)

Must match IRS records exactly.

7. Total number of W-2 forms attached

SSA checks this number against your actual submission.

W-3 vs W-2: What’s the Difference?

|

W-2 Form |

W-3 Form |

|

One per employee |

One per employer |

|

Shows individual wages |

Summarizes all wages |

|

Given to employees |

Sent only to SSA |

|

Required for tax filing |

Required for W-2 processing |

|

Lists employee taxes |

Lists total business taxes |

How a W-3 Works

If you run a small business with 5 employees.

You issued these W-2 totals:

-

Total wages: $210,000

-

Federal income tax withheld: $28,300

-

Social Security wages: $210,000

-

Social Security tax withheld: $13,020

-

Medicare wages: $210,000

-

Medicare tax withheld: $3,045

Your W-3 simply adds up all five W-2s and reports the totals above.

How To Fill Out a W-3 Form

Step 1 (Gather all W-2s)

Get wage, tax, and benefit information for each employee.

Step 2 (Enter employer details)

EIN, business name, address, and contact information.

Step 3 (Add totals from all W-2s)

Wages, tips, federal withholding, Social Security & Medicare amounts.

Step 4 (Review everything)

Make sure totals match. A mismatch triggers SSA rejections.

Step 5 (Sign and date)

Certifies that everything is accurate.

Step 6 (Submit to SSA)

Either:

-

By paper (mail)

-

Electronically (BSO) — required if you file 250+ W-2s

Electronic filing is recommended for everyone fewer errors, quicker confirmation.

When Is Form W-3 Due?

Form W-3 is always due on January 31 (same date you must send W-2s to employees)

This deadline applies to both:

-

Paper filing

-

Electronic filing

Penalties for Filing W-3 Late

|

Filing Time |

Penalty (Per Form) |

|

Within 30 days |

$50 |

|

After 30 days (before Aug 1) |

$110 |

|

After Aug 1 or not filed |

$290 |

|

Intentional disregard |

$580+ |

These penalties apply per employee, so missing the deadline can get expensive fast.

Common Mistakes When Filing a W-3

-

Mismatched totals : W-3 totals must equal the sum of all W-2s.

-

Incorrect EIN : Biggest reason SSA rejects submissions.

-

Late filing : Triggers avoidable penalties.

-

Incorrect wage amounts : Leads to issues with employee Social Security earnings.

-

Missing signature (paper filings) : SSA will return the form.

Employer Checklist Before Filing W-3

-

All W-2s reviewed

-

Employer EIN correct

-

Social Security & Medicare wages calculated correctly

-

W-3 totals match all W-2 totals

-

January 31 deadline added to calendar

-

Submitted electronically via BSO (recommended)

Conclusion

The W-3 form may look simple, but it plays a major role in payroll reporting. Filing it correctly ensures your employees’ earnings are recorded properly, your tax filings stay compliant, and you avoid unnecessary penalties.

Stay organized, double-check your totals, and submit everything by January 31 and W-3 filing becomes straightforward.

FAQs

Do I need to file a W-3 if I have only one employee?

Yes. Even if you issue just one W-2, you must file a W-3.

Do I need a W-3 for contractors?

No. Contractors receive Form 1099-NEC, not W-2.

Can I file W-3 electronically?

Yes, through the SSA’s Business Services Online (BSO). It’s faster and more accurate.

What if I made a mistake?

File Form W-3c (Corrected Transmittal).

What happens if totals don’t match?

SSA may reject your filing or delay employee earnings updates.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.