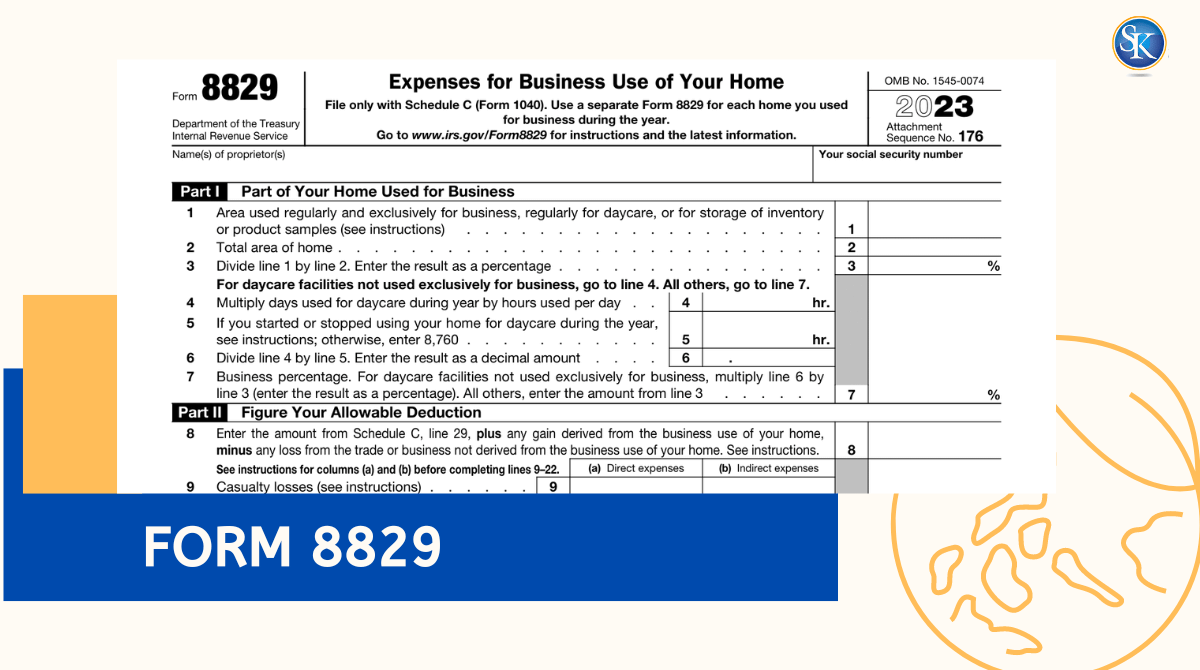

IRS Form 8829 : A Complete Guide to Expensing Your Home Office

If you use part of your home for business, IRS Form 8829 can help you lower your tax bill. This form lets you deduct the costs of maintaining your home office from rent and utilities to insurance and repairs. For freelancers, small business owners, and self employed professionals, it’s a simple way to convert regular home expenses into business savings.

Find here: Top accounting and bookkeeping services in FL, US

What Is IRS Form 8829?

Form 8829 is the official IRS document that helps you calculate how much of your home expenses can be deducted for business. You can include costs like:

-

Mortgage interest or rent

-

Property taxes

-

Utilities and repairs

-

Home insurance

-

Depreciation

When you fill it out, the total deduction moves to Schedule C (Form 1040) and directly lowers your taxable business income.

Note: According to IRS data, millions of Americans work from home each year, yet many miss this deduction simply because they don’t know how to file it properly.

Here you can find information about all tax forms

Who Should File Form 8829?

To qualify, the space must be used exclusively and regularly for business. For example, if you run an online shop from a spare room that’s only used for business activities, that space qualifies. If you use your dining table for both work and family meals, it doesn’t.

Tip : The IRS is very strict about the “exclusive use” rule, so make sure your workspace meets this standard before you file.

How Form 8829 Works in Simple Terms

Think of Form 8829 as a math formula that tells the IRS how much of your home is used for business. You calculate the percentage of space and apply that number to your household costs.

For example, if your office takes up 15% of your home, you can claim 15% of eligible home expenses as a business deduction.

Step-by-Step Guide to Filling Out Form 8829

Part I – Calculate Business Use Percentage

-

Measure total area of your home.

-

Measure your office area.

-

Divide office area by total area to find business-use percentage.

Part II – Direct and Indirect Expenses

There are two kinds of expenses you’ll record direct and indirect.

-

Direct Expenses: Repairs or costs for the office only (painting, shelves).

-

Indirect Expenses: Costs for the entire home (utilities, property taxes, mortgage interest).

If your annual utilities are $3,000 and your office use is 15%, you can deduct $450.

Part III – Depreciation of Your Home

Depreciation lets you spread out your home’s cost over time. It’s useful if you own your home and want to claim yearly wear and tear. If you rent, you can skip this part.

Part IV – Carryover of Unallowed Expenses

If your deduction is bigger than your income this year, don’t worry. You can carry the extra amount forward and use it next year.

Simplified Option vs. Form 8829: Which Is Better?

The IRS gives two methods to claim a home office deduction the simplified method and the regular Form 8829 method.

|

Method |

Max Area |

Deduction |

Record Keeping |

|

Simplified |

300 sq ft |

$5 per sq ft |

Minimal paperwork |

|

Regular (Form 8829) |

Actual size |

Based on real expenses |

Requires receipts |

If your home office is large or your expenses are high, using Form 8829 usually gives you a bigger deduction. If you want a faster route with less paperwork, the simplified option might be enough.

Benefits of Filing Form 8829

Claiming this deduction can save you hundreds or even thousands in taxes every year.

For instance, if you spend $10,000 yearly on rent, utilities, and maintenance, and your office covers 15% of your home, you could deduct around $1,500.

Common Mistakes to Avoid

Even a small error can make the IRS question your deduction.

-

Claiming a shared space (like a guest room) as an office.

-

Guessing the office size instead of measuring it.

-

Forgetting to keep bills and receipts.

-

Applying the wrong business-use percentage.

Conclusion

Form 8829 offers a valuable way for home-based business owners to reduce their taxable income by claiming legitimate deductions for business-related home expenses. By carefully following the steps outlined above and ensuring accuracy in your calculations and record-keeping, you can make the most of this tax benefit while staying compliant with IRS rules.

If you’re unsure how to calculate or file, it’s worth asking a tax professional for help. They’ll ensure you get the maximum legal deduction without risking an IRS issue.

FAQs

Is Form 8829 mandatory for a home office deduction?

No. You can use the simplified method instead if you prefer fewer calculations.

Can renters use Form 8829?

Yes. Renters can claim a portion of rent and home expenses if the space qualifies.

Does the home office need to be a separate room?

No. It just needs to be a clearly defined area used only for business.

Can I claim internet or phone bills?

Yes, if they’re used for business. Only deduct the business-use portion.

What if I stop using my home office mid-year?

You can still claim the deduction for the months it was used for business.

Can I claim a home office deduction if my business loses money?

You can, but the deduction can’t create a business loss. Extra expenses carry forward.

Do I need to include depreciation if I rent my home?

No. Depreciation applies only to homeowners, not renters.

How long should I keep my expense records?

Keep all receipts and documentation for at least three years after filing.

Can I claim both Form 8829 and the simplified method in the same year?

No. You must choose one method per tax year.

What’s the biggest mistake people make with Form 8829?

Claiming a shared space that isn’t used exclusively for business.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.