How to issue a 1099? Common Mistakes to Avoid

If you paid independent contractors or freelancers during the year, issuing a 1099 is not optional it’s a required part of staying compliant with IRS rules. The good news is that issuing a 1099 is much simpler than it sounds when you understand the steps and timelines.

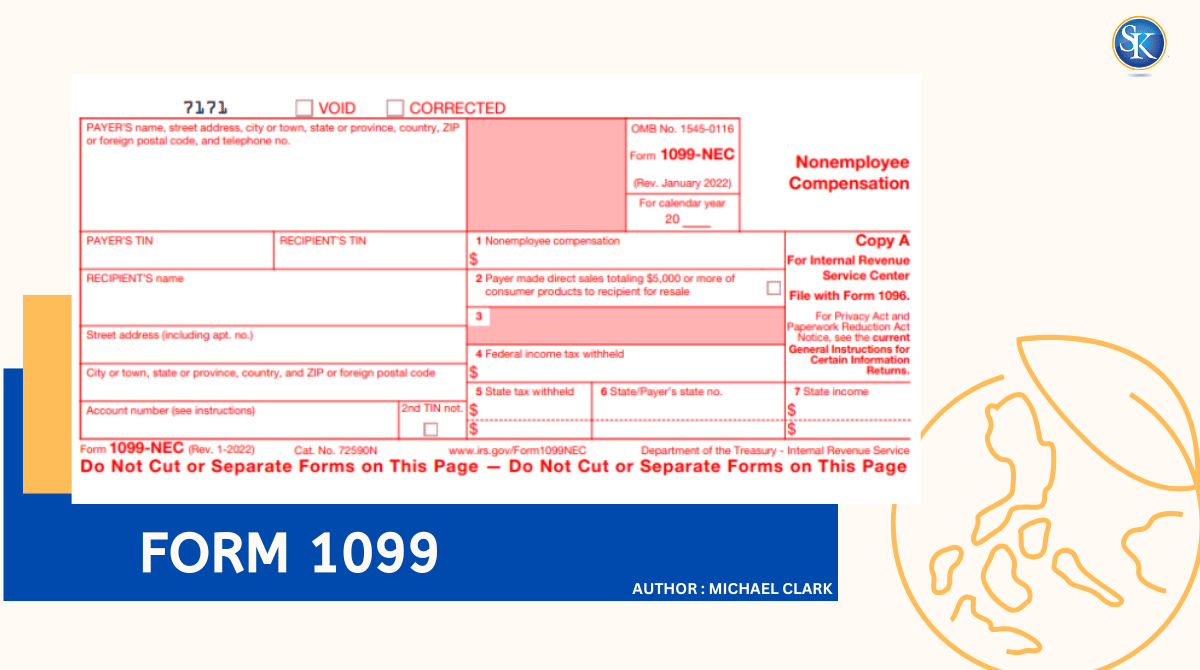

To issue a 1099, you collect a completed W-9 from your contractor, fill out Form 1099-NEC with their payment details, send them a copy, and file the form with the IRS by January 31.

What Is a 1099 Form?

A 1099 form is an IRS document used to report income paid to someone who is not your employee. Businesses use it to report payments made to freelancers, independent contractors, and other self-employed individuals.

The most common form businesses use is Form 1099-NEC (Nonemployee Compensation). It replaced the contractor portion of Form 1099-MISC starting in 2020 and is now the standard form for reporting contractor payments.

Issuing a 1099 helps the IRS track income accurately and ensures contractors report what they earned. Failing to issue a required 1099 can lead to penalties and unnecessary IRS attention.

Who Needs to Receive a 1099?

You generally must issue a 1099-NEC if:

-

You paid $600 or more during the year

-

The payment was for services

-

The worker is not your employee

-

The recipient is an individual, sole proprietor, or partnership

Common examples include freelance writers, designers, consultants, developers, virtual assistants, and independent service providers.

Example: If you hired a freelance web designer and paid them $1,200 for a project, you are required to issue a 1099-NEC for that payment.

When You Do Not Need to Issue a 1099

Not every payment requires a 1099. In most cases, you do not need to issue one if:

-

Payments were made by credit card or third-party platforms like PayPal or Stripe

-

The vendor is a corporation (S-Corp or C-Corp), with limited exceptions

-

Payments were for products or goods, not services

Knowing these exceptions helps avoid unnecessary paperwork and incorrect filings.

Need to file: 1040 vs 1099 form

How to Collect the Information You Need

Before issuing a 1099, you must collect accurate information from each contractor. This is done using Form W-9, which provides:

-

Legal name

-

Business address

-

Social Security Number (SSN) or Employer Identification Number (EIN)

-

Tax classification

The best practice is to request a W-9 before you make the first payment, not at the end of the year. This ensures you have everything ready when tax season arrives. If a contractor refuses to provide a W-9, you may be required to withhold 24% of future payments, known as backup withholding.

How to Issue a 1099 Step by Step

Issuing a 1099 becomes straightforward when broken into simple steps.

Step 1: Gather Contractor Details

Use the W-9 to confirm the contractor’s legal name, address, and tax ID. Review your records to calculate the total amount paid during the year.

Step 2: Choose How You Will File

You can file manually or electronically. Most businesses prefer electronic filing because it reduces errors and saves time. Accounting software and tax platforms often generate and submit 1099s automatically.

Step 3: Complete Form 1099-NEC

Fill in:

-

Your business name, address, and EIN

-

The contractor’s information

-

Total nonemployee compensation in Box 1

Even small mistakes, such as incorrect names or numbers, can cause filing issues, so double-check everything.

Step 4: Send the Required Copies

-

Send Copy B and Copy C to the contractor by January 31

-

File Copy A with the IRS by January 31

If you file electronically, you do not need to submit Form 1096.

Step 5: Check State Filing Requirements

Some states require separate 1099 filings. Requirements vary, so confirm whether your state has additional reporting rules.

1099-NEC vs W-2: What’s the Difference?

Form 1099-NEC is used for independent contractors, who are responsible for paying their own taxes. Form W-2 is used for employees, where employers withhold income and payroll taxes.

Misclassifying workers can result in audits, back taxes, and penalties. If you’re unsure whether a worker is an employee or contractor, it’s important to review IRS guidelines or seek professional advice.

Filing Deadlines and Penalties to Know

Meeting deadlines is critical when issuing 1099s.

-

January 31: Deadline to send 1099s to contractors and file with the IRS

-

Penalties range from $50 to $290 per form, depending on how late the filing is

Planning ahead and collecting W-9s early can help you avoid last-minute stress and unnecessary fines.

Common 1099 Mistakes to Avoid

Many businesses run into trouble due to late filings, incorrect contractor information, missing W-9s, or issuing 1099s to vendors who don’t require them. Staying organized, reviewing details carefully, and understanding the rules can prevent most issues before they happen.

Why Choose SK Financial for 1099 Filing?

With over 24+ years of experience, we help businesses manage 1099 filings accurately and on time. From collecting contractor information to ensuring IRS compliance, our team handles the details so you can focus on running your business with confidence.

Conclusion

Issuing a 1099 doesn’t have to be stressful. When you understand who needs one, collect the right information early, and follow a clear process, filing becomes simple and manageable. And if you ever need support, professional guidance can make tax season far smoother and worry-free.

FAQs

Do I need to issue a 1099 to corporations?

Generally, no. Corporations usually do not receive 1099s unless specific exceptions apply, such as payments to attorneys.

What happens if I miss the January 31 deadline?

Late filings can result in penalties that increase the longer the delay continues.

Can I file 1099s electronically?

Yes. Electronic filing is encouraged and often faster and more accurate than paper filing.

What is backup withholding?

Backup withholding requires you to withhold 24% of payments if a contractor fails to provide valid tax information.

Where can I get 1099 forms?

You can obtain them from the IRS website or generate them using accounting or tax software.

Follow SKFinancial on Facebook / Twitter / Linkedin / Youtube for updates.